Question: Question 4 (20 Marks) REQUIRED Use the information provided below to compile the: 4.1 Pro Forma Statement of Comprehensive Income for the year ended 31

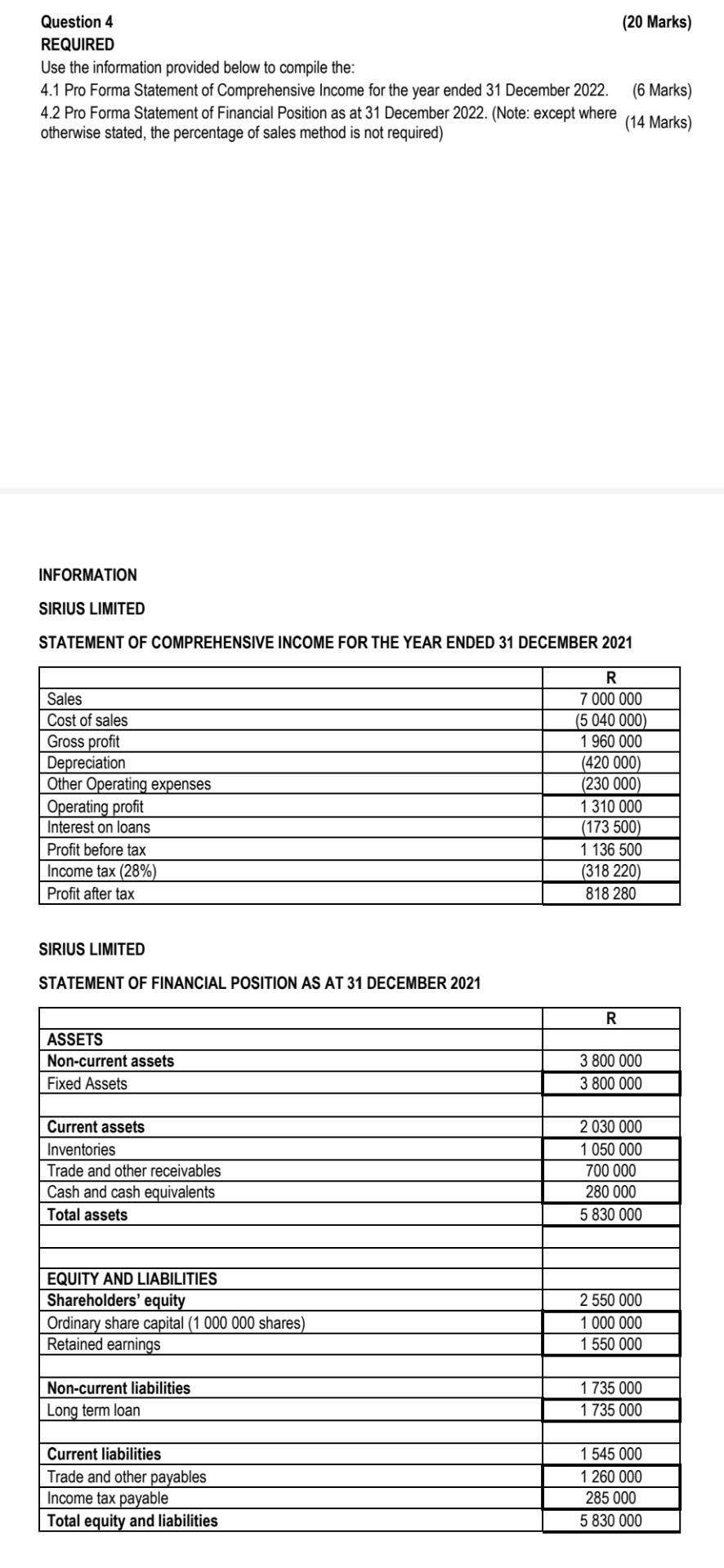

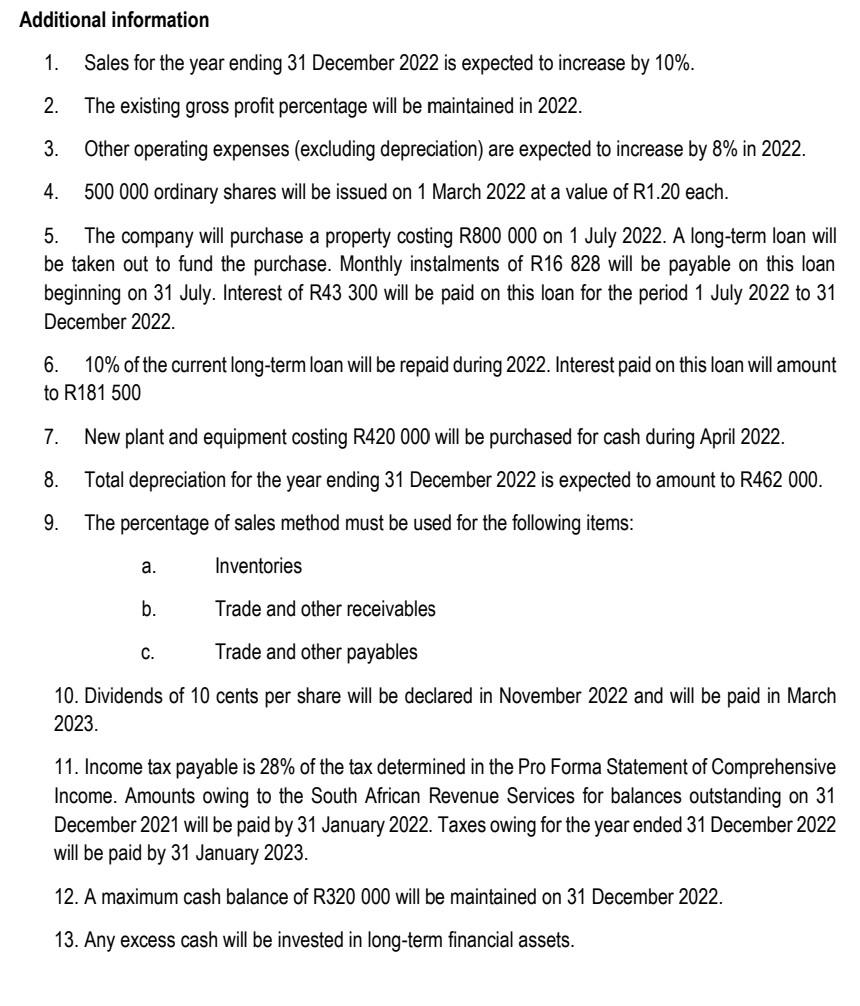

Question 4 (20 Marks) REQUIRED Use the information provided below to compile the: 4.1 Pro Forma Statement of Comprehensive Income for the year ended 31 December 2022. (6 Marks) 4.2 Pro Forma Statement of Financial Position as at 31 December 2022. (Note: except where (14 Marks) otherwise stated, the percentage of sales method is not required) INFORMATION SIRIUS LIMITED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2021 SIRIUS LIMITED STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2021 9. The percentage of sales method must be used for the following items: a. Inventories b. Trade and other receivables c. Trade and other payables 10. Dividends of 10 cents per share will be declared in November 2022 and will be paid in March 2023. 11. Income tax payable is 28% of the tax determined in the Pro Forma Statement of Comprehensive Income. Amounts owing to the South African Revenue Services for balances outstanding on 31 December 2021 will be paid by 31 January 2022. Taxes owing for the year ended 31 December 2022 will be paid by 31 January 2023. 12. A maximum cash balance of R320000 will be maintained on 31 December 2022. 13. Any excess cash will be invested in long-term financial assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts