Question: QUESTION 4 (20 MARKS) REQUIRED Use the information provided below to prepare the Cash Flow Statement of Nascar Limited for the year ended 31 December

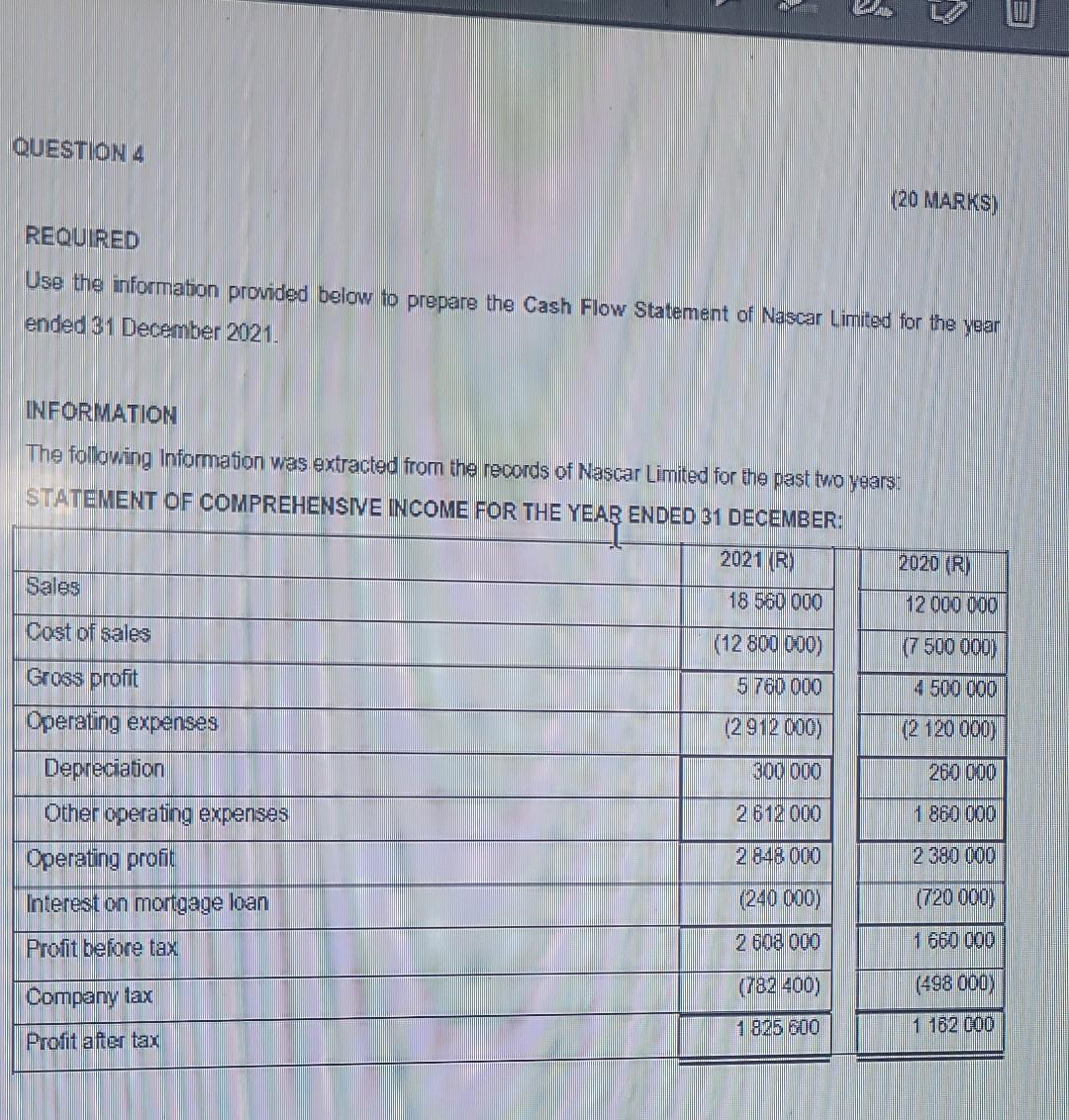

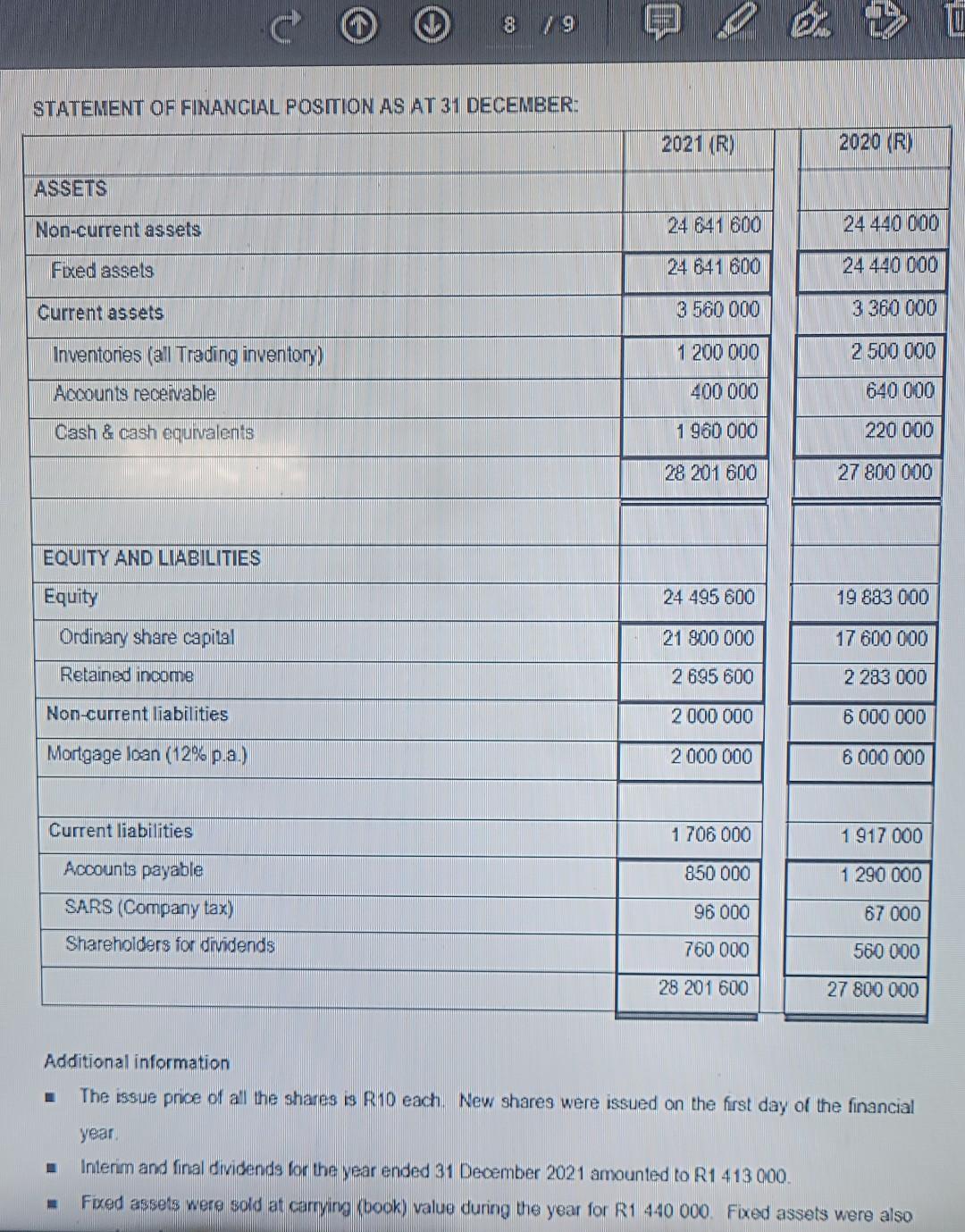

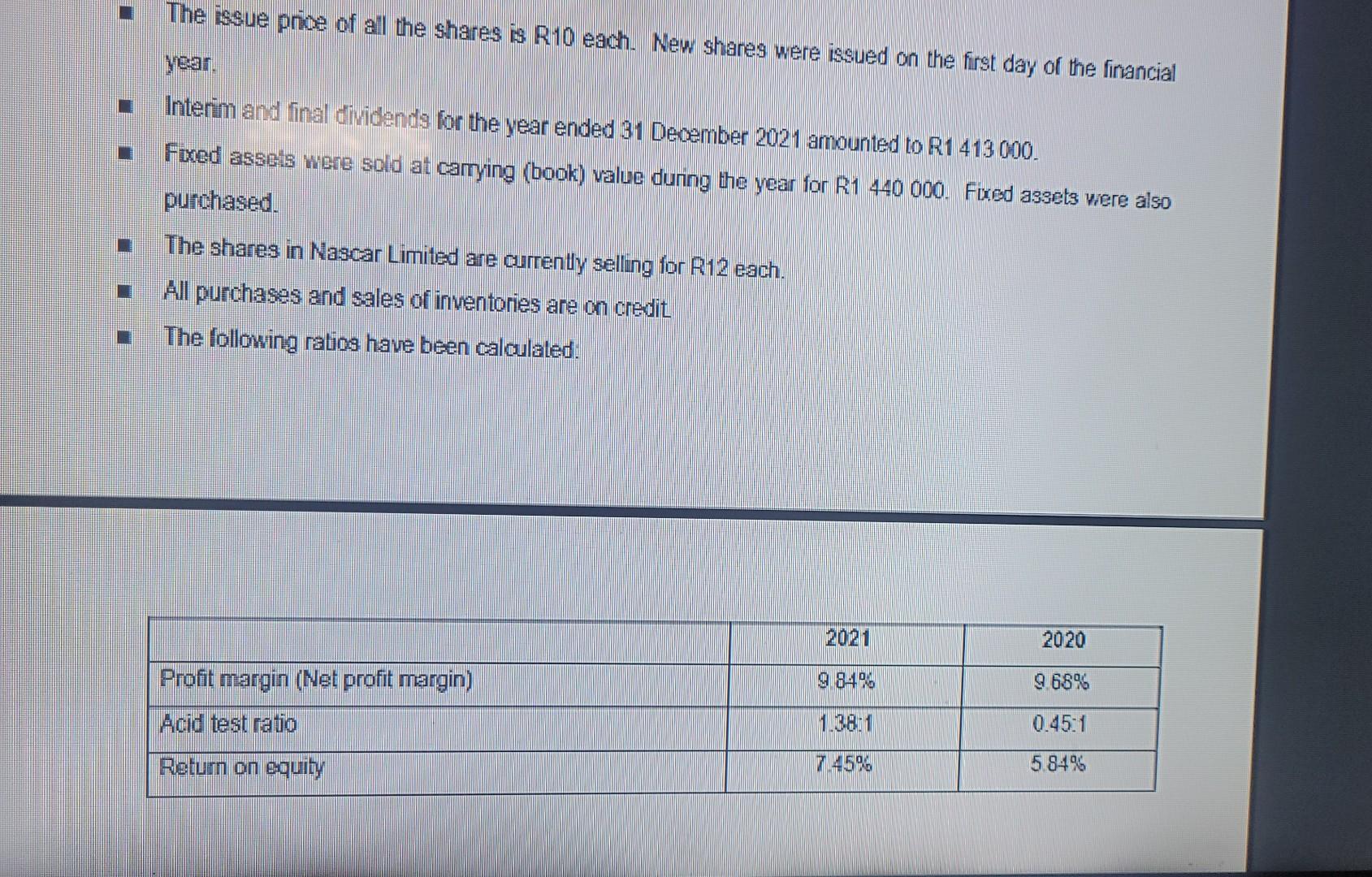

QUESTION 4 (20 MARKS) REQUIRED Use the information provided below to prepare the Cash Flow Statement of Nascar Limited for the year ended 31 December 2021. INFORMATION The following Information was extracted from the records of Nascar Limited for the past two years: STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER: 2021 (R) 2020 (R) Sales 18 560 000 12 000 000 Cost of sales (12 800 000) (7 500 000) Gross profit 5 760 000 4 500 000 Operating expenses (2 912 000) (2 120 000) Depreciation 300 000 260 000 Other operating expenses 2 612 000 1 860 000 Operating profit 2 848 000 2 380 000 Interest on mortgage loan (240 000) (720 000) Profit before tax 2 608 000 1 660 000 Company tax (782 400) (498 000) Profit after tax 1 825 600 1 162 000 STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER: 2021 (R) 2020 (R) ASSETS Non-current assets 24 641 600 24 440 000 Fixed assets 24 641 600 24 440 000 Current assets 3 560 000 3 360 000 Inventories (all Trading inventory) 1 200 000 2 500 000 Accounts receivable 400 000 640 000 Cash & cash equivalents 1 960 000 220 000 28 201 600 27 800 000 EQUITY AND LIABILITIES Equity 24 495 600 19 883 000 Ordinary share capital 21 800 000 17 600 000 Retained income 2 695 600 2 283 000 Non-current liabilities 2 000 000 6 000 000 Mortgage loan (12% p.a.) 2 000 000 6 000 000 Current liabilities 1 706 000 1 917 000 Accounts payable 850 000 1 290 000 SARS (Company tax) 96 000 67 000 Shareholders for dividends 760 000 560 000 28 201 600 27 800 000 Additional information The issue price of all the shares is R10 each. New shares were issued on the first day of the financial year. Interim and final dividends for the year ended 31 December 2021 amounted to R1 413 000. Fixed assets were sold at carrying (book) value during the year for R1 440 000. Fixed assets were also purchased. The shares in Nascar Limited are currently selling for R12 each. All purchases and sales of inventories are on credit. The following ratios have been calculated: 2021 2020 Profit margin (Net profit margin) 9.84% 9.68% Acid test ratio 1.38:1 0.45:1 Return on equity 7.45% 5.84%

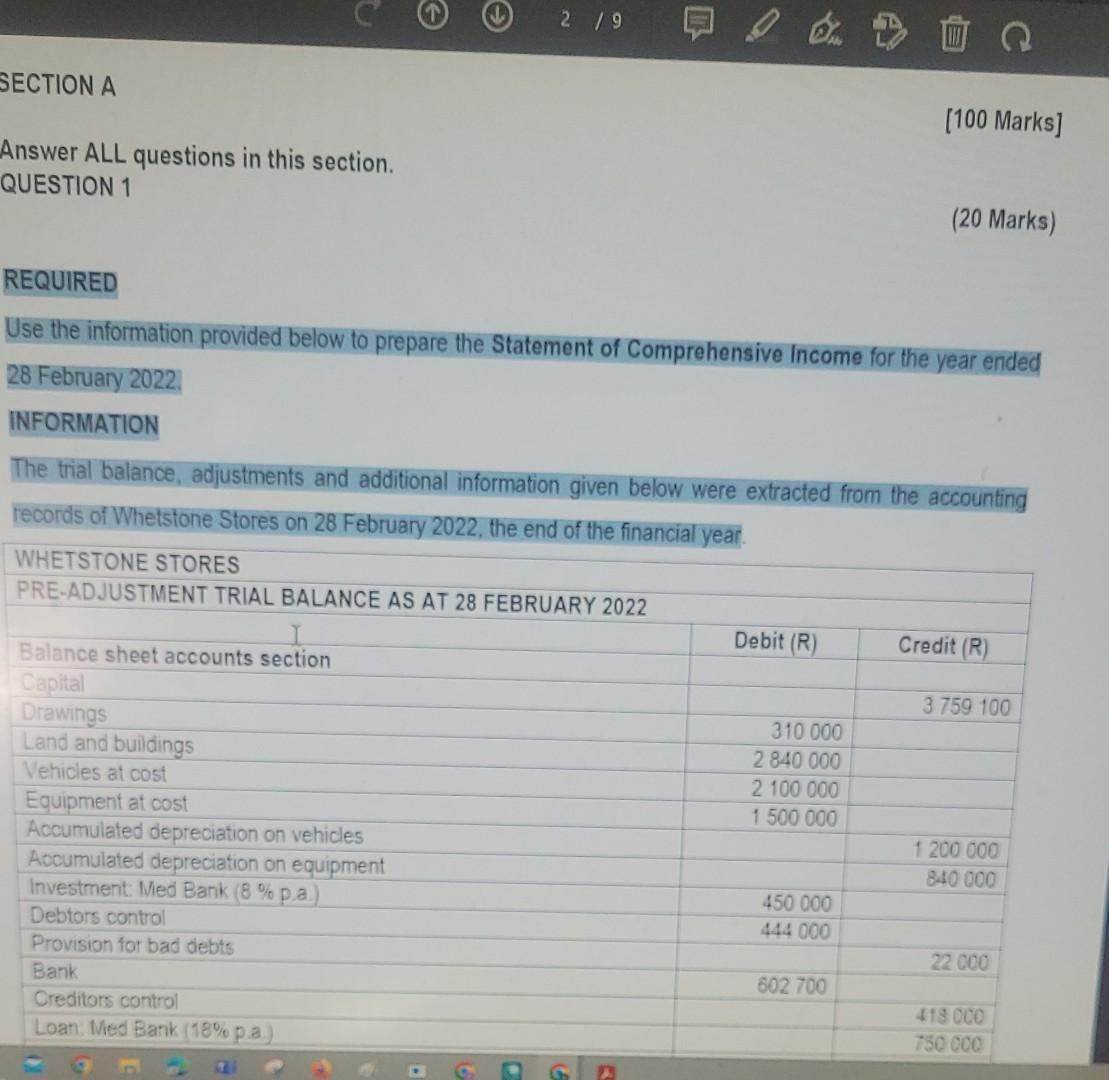

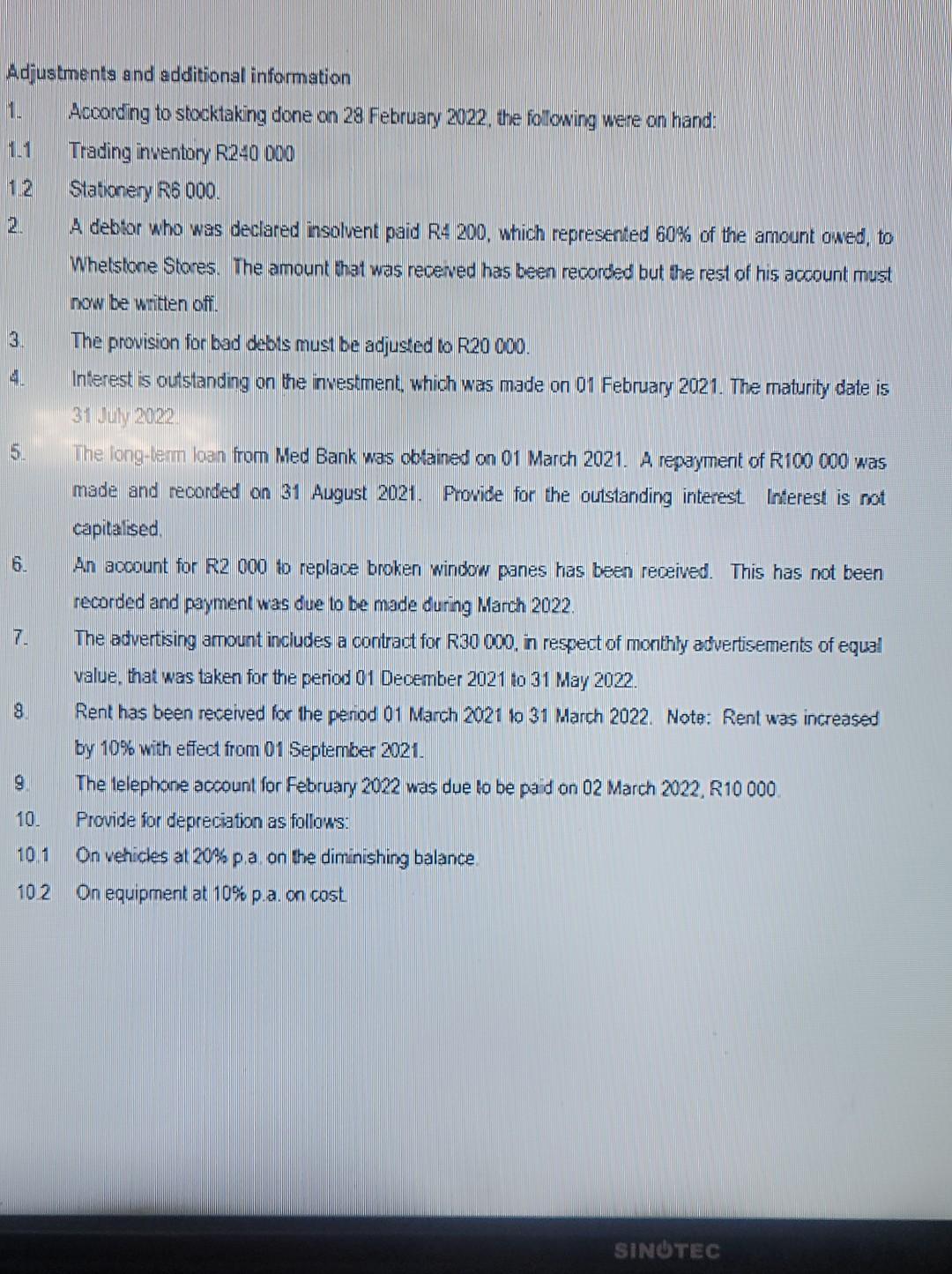

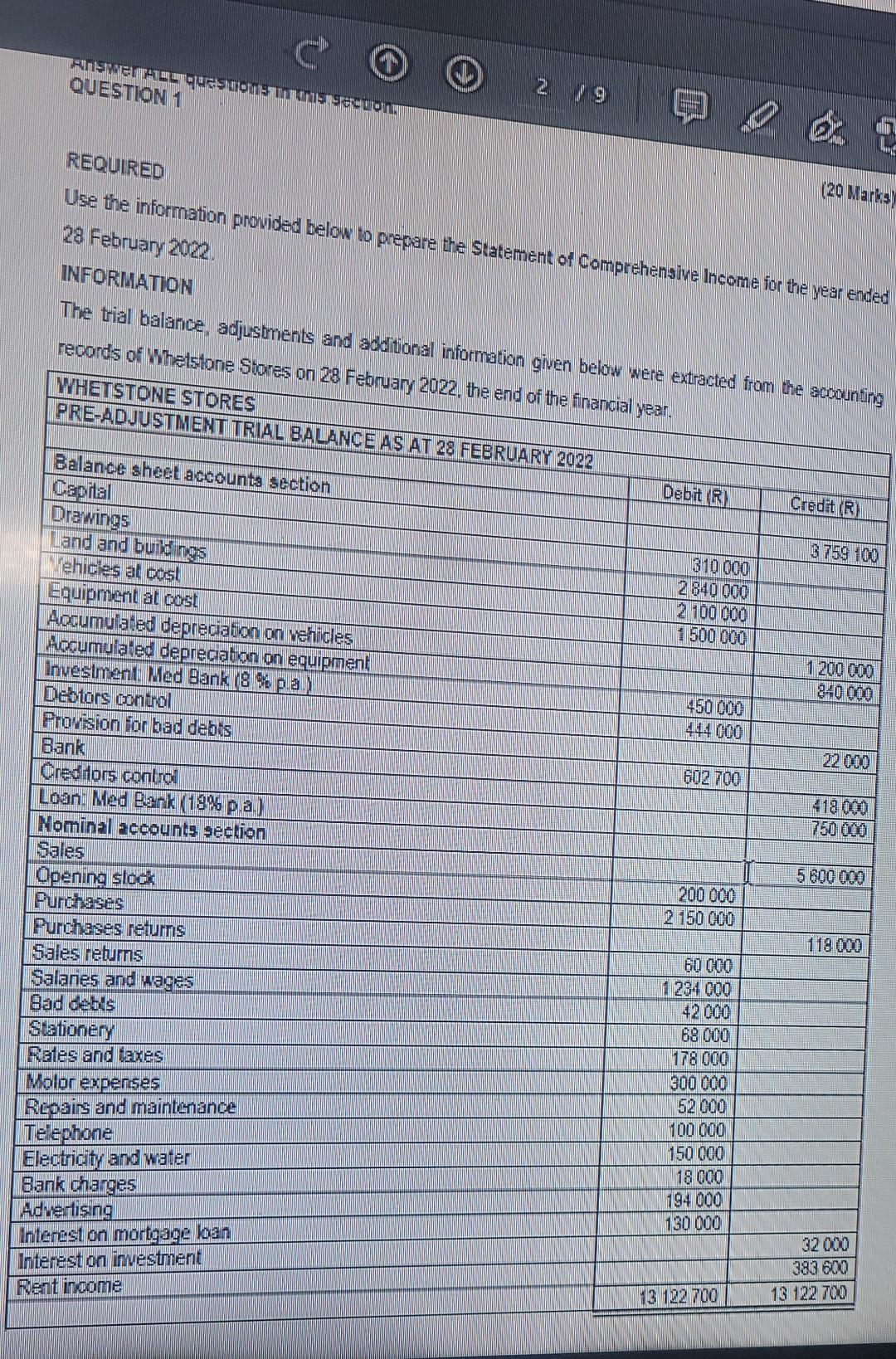

Answer ALL questions in this section. QUESTION 1 Adjustments and additional information 1. Acoording to stocktaking done on 28 February 2022 , the following were on hand: 1.1 Trading inventory R240 000 12 Stationery R6000. 2. A debtor who was declared insolvent paid RA 200 , which represented 60% of the amount owed, to Whelslone Stores. The amount that was received has been recorded but the rest of his account must now be written off. 3. The provision for bad debts must be adjusted to R20 000 . 4. Interest is outstanding on the investment, which was made on 01 February 2021. The maturity date is 31 July 2022 5. The long-lerm loan from Med Bank was obtained on 01 March 2021. A repayment of R100 000 was made and reconded on 31 August 2021 . Provide for the outstanding interest Interest is not capitalised. 6. An aocount for R2 000 to replace broken window panes has been received. This has not been recorded and payment was due to be made during March 2022. 7. The advertising amount includes a contract for R30 000, in respect of monthly advertisements of equal value, that was taken for the period 01 December 2021 to 31 May 2022. 8. Rent has been received for the period 01 March 2021 b 31 March 2022 . Note: Rent was increased by 10% with effed from 01 September 2021 . 9. The lelephone account for February 2022 was due to be paid on 02 March 2022, R10 000 . 10. Provide for depreciation as follows: 10.1 On vehicles at 20% p a on the diminishing balance. 102 On equipment at 10% p.a. on cost REQUIRED (20 Marks) Use the information provided below to prepare the Statement of Comprehensive Income for the year ended 28 February 2022 INFORIATION The trial balance, adjustments and additional information given below were extramtan os records of Whetstone Stores on 28 Fehm REQUIRED Use the information provided below to prepare the Cash Flow Statement of Nascar Limited for the year ended 31 December 2021. INFORMATION The following Information was extracted from the records of Nascar Limited for the past two years: STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER: STATEMENT OF FINANCLAL POSTION AS AT 31 DECEMBER: \begin{tabular}{|r|} \hline 2020(R) \\ \hline 24440000 \\ \hline 24440000 \\ \hline 3360000 \\ \hline 2500000 \\ \hline 640000 \\ \hline 220000 \\ \hline 27800000 \\ \hline \hline \\ \hline \\ \hline 19883000 \\ \hline 17600000 \\ \hline 2283000 \\ \hline 6000000 \\ \hline 6000000 \\ \hline 27800000 \\ \hline 1917000 \\ \hline 1290000 \\ \hline 67000 \\ \hline 560000 \\ \hline \hline \end{tabular} Additional information - The issue price of all the shares is R10 each. New shares were issued on the first day of the financial year. - Interim and final dividends for the year ended 31 December 2021 amounted to R1413000. = Fixed assets were sold at carrying (book) value during the year for R1 440000 . Fixed assets were also The issue price of all the shares is R10 each. New shares were issued on the first day of the financial year. Interim and linal dividends for the year ended 31 December 2021 amounted to R1 413000 . Fixed assets were soid at camying (book) value during the year for R1 440000 . Fixad assets were also purchased. The shares in Nascar Limited are currenty selling for F12 each. All purchases and sales of inventories are on credit The following ratios have been calculated. Answer ALL questions in this section. QUESTION 1 Adjustments and additional information 1. Acoording to stocktaking done on 28 February 2022 , the following were on hand: 1.1 Trading inventory R240 000 12 Stationery R6000. 2. A debtor who was declared insolvent paid RA 200 , which represented 60% of the amount owed, to Whelslone Stores. The amount that was received has been recorded but the rest of his account must now be written off. 3. The provision for bad debts must be adjusted to R20 000 . 4. Interest is outstanding on the investment, which was made on 01 February 2021. The maturity date is 31 July 2022 5. The long-lerm loan from Med Bank was obtained on 01 March 2021. A repayment of R100 000 was made and reconded on 31 August 2021 . Provide for the outstanding interest Interest is not capitalised. 6. An aocount for R2 000 to replace broken window panes has been received. This has not been recorded and payment was due to be made during March 2022. 7. The advertising amount includes a contract for R30 000, in respect of monthly advertisements of equal value, that was taken for the period 01 December 2021 to 31 May 2022. 8. Rent has been received for the period 01 March 2021 b 31 March 2022 . Note: Rent was increased by 10% with effed from 01 September 2021 . 9. The lelephone account for February 2022 was due to be paid on 02 March 2022, R10 000 . 10. Provide for depreciation as follows: 10.1 On vehicles at 20% p a on the diminishing balance. 102 On equipment at 10% p.a. on cost REQUIRED (20 Marks) Use the information provided below to prepare the Statement of Comprehensive Income for the year ended 28 February 2022 INFORIATION The trial balance, adjustments and additional information given below were extramtan os records of Whetstone Stores on 28 Fehm REQUIRED Use the information provided below to prepare the Cash Flow Statement of Nascar Limited for the year ended 31 December 2021. INFORMATION The following Information was extracted from the records of Nascar Limited for the past two years: STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER: STATEMENT OF FINANCLAL POSTION AS AT 31 DECEMBER: \begin{tabular}{|r|} \hline 2020(R) \\ \hline 24440000 \\ \hline 24440000 \\ \hline 3360000 \\ \hline 2500000 \\ \hline 640000 \\ \hline 220000 \\ \hline 27800000 \\ \hline \hline \\ \hline \\ \hline 19883000 \\ \hline 17600000 \\ \hline 2283000 \\ \hline 6000000 \\ \hline 6000000 \\ \hline 27800000 \\ \hline 1917000 \\ \hline 1290000 \\ \hline 67000 \\ \hline 560000 \\ \hline \hline \end{tabular} Additional information - The issue price of all the shares is R10 each. New shares were issued on the first day of the financial year. - Interim and final dividends for the year ended 31 December 2021 amounted to R1413000. = Fixed assets were sold at carrying (book) value during the year for R1 440000 . Fixed assets were also The issue price of all the shares is R10 each. New shares were issued on the first day of the financial year. Interim and linal dividends for the year ended 31 December 2021 amounted to R1 413000 . Fixed assets were soid at camying (book) value during the year for R1 440000 . Fixad assets were also purchased. The shares in Nascar Limited are currenty selling for F12 each. All purchases and sales of inventories are on credit The following ratios have been calculated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts