Question: Question 4 (20 points) Part A (10 points) Headquartered in Toronto, Canada, Toronto Royal Estate Inc. is an expanding real estate agency with presence all

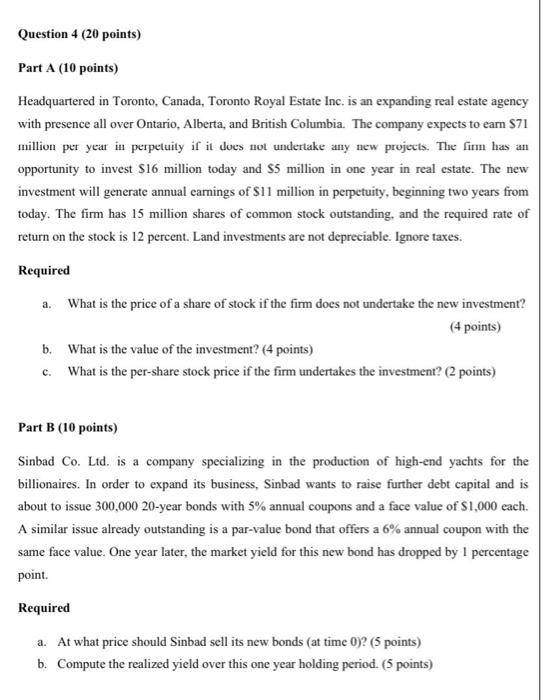

Question 4 (20 points) Part A (10 points) Headquartered in Toronto, Canada, Toronto Royal Estate Inc. is an expanding real estate agency with presence all over Ontario, Alberta, and British Columbia. The company expects to earn $71 million per year in perpetuity if it does not undertake any new projects. The firm has an opportunity to invest $16 million today and $5 million in one year in real estate. The new investment will generate annual earnings of $11 million in perpetuity, beginning two years from today. The firm has 15 million shares of common stock outstanding, and the required rate of return on the stock is 12 percent. Land investments are not depreciable. Ignore taxes. Required a. What is the price of a share of stock if the firm does not undertake the new investment? (4 points) b. What is the value of the investment? (4 points) c. What is the per-share stock price if the firm undertakes the investment? (2 points) Part B (10 points) Sinbad Co. Ltd. is a company specializing in the production of high-end yachts for the billionaires. In order to expand its business, Sinbad wants to raise further debt capital and is about to issue 300,000 20-year bonds with 5% annual coupons and a face value of $1,000 each. A similar issue already outstanding is a par-value bond that offers a 6% annual coupon with the same face value. One year later, the market yield for this new bond has dropped by 1 percentage point. Required a. At what price should Sinbad sell its new bonds (at time 0)? (5 points) b. Compute the realized yield over this one year holding period. (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts