Question: Question 4 (20 points total) Anglo-American Aerospace (AAA) is a manufacturer of space alloys interested in making an acquisition of Airbus (Airbus), a maker of

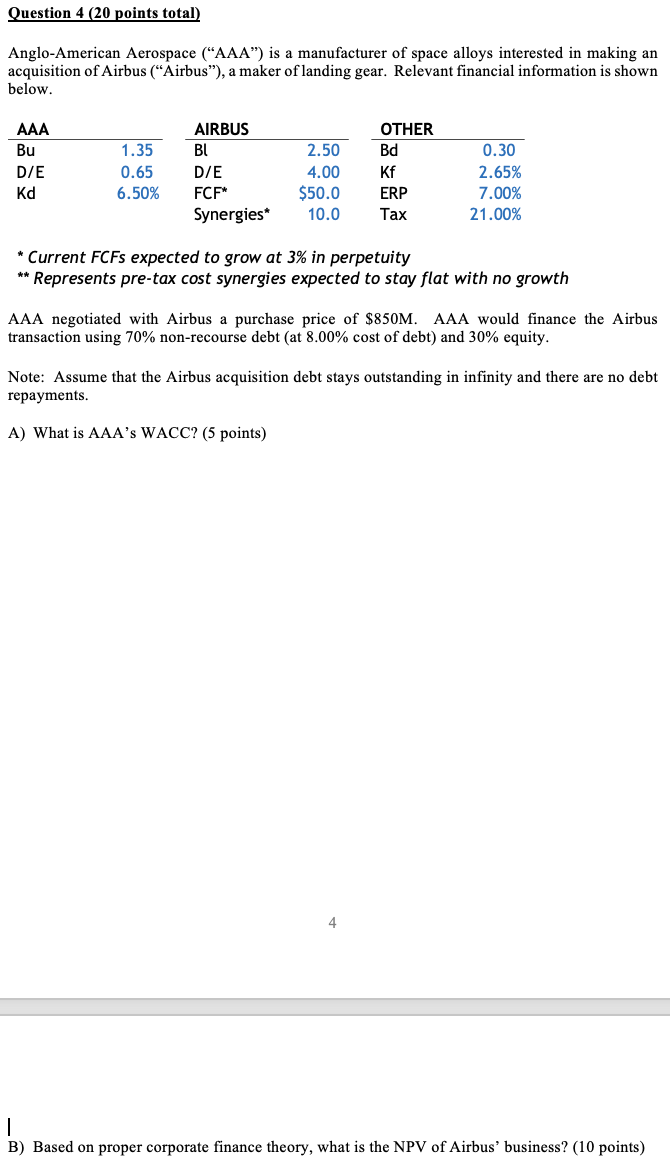

Question 4 (20 points total) Anglo-American Aerospace ("AAA") is a manufacturer of space alloys interested in making an acquisition of Airbus (Airbus), a maker of landing gear. Relevant financial information is shown below. AAA Bu D/E Kd 1.35 0.65 6.50% AIRBUS BL D/E FCF* Synergies* 2.50 4.00 $50.0 10.0 OTHER Bd Kf ERP Tax 0.30 2.65% 7.00% 21.00% * Current FCFs expected to grow at 3% in perpetuity ** Represents pre-tax cost synergies expected to stay flat with no growth AAA negotiated with Airbus a purchase price of $850M. AAA would finance the Airbus transaction using 70% non-recourse debt (at 8.00% cost of debt) and 30% equity. Note: Assume that the Airbus acquisition debt stays outstanding in infinity and there are no debt repayments. A) What is AAA's WACC? (5 points) 4 B) Based on proper corporate finance theory, what is the NPV of Airbus' business? (10 points) Question 4 (20 points total) Anglo-American Aerospace ("AAA") is a manufacturer of space alloys interested in making an acquisition of Airbus (Airbus), a maker of landing gear. Relevant financial information is shown below. AAA Bu D/E Kd 1.35 0.65 6.50% AIRBUS BL D/E FCF* Synergies* 2.50 4.00 $50.0 10.0 OTHER Bd Kf ERP Tax 0.30 2.65% 7.00% 21.00% * Current FCFs expected to grow at 3% in perpetuity ** Represents pre-tax cost synergies expected to stay flat with no growth AAA negotiated with Airbus a purchase price of $850M. AAA would finance the Airbus transaction using 70% non-recourse debt (at 8.00% cost of debt) and 30% equity. Note: Assume that the Airbus acquisition debt stays outstanding in infinity and there are no debt repayments. A) What is AAA's WACC? (5 points) 4 B) Based on proper corporate finance theory, what is the NPV of Airbus' business? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts