Question: Question 4 20 pts Machinex Inc. is financed with 50% equity and 50% debt and there are no taxes. Assuming Machinex decides to increase its

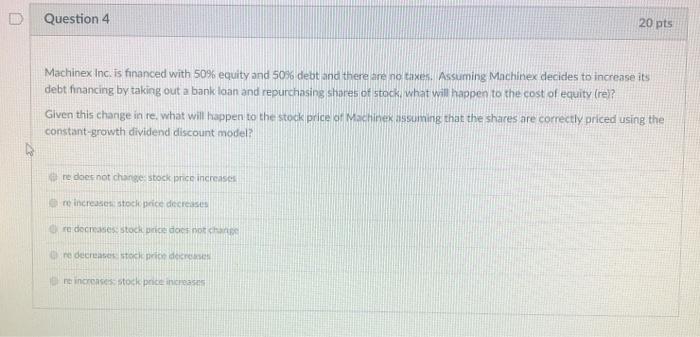

Question 4 20 pts Machinex Inc. is financed with 50% equity and 50% debt and there are no taxes. Assuming Machinex decides to increase its debt financing by taking out a bank loan and repurchasing shares of stock what will happen to the cost of equity (rel? Given this change in re, what will happen to the stock price of Machinex assuming that the shares are correctly priced using the constant-growth dividend discount model? ere does not change stock price increases e increases Stoch price dece Ore decreases Stoch does not Ore decrease the price is reincreases stock price increases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts