Question: Question 4 (21 points) Saved Listen Clearview Systems Ltd. is considering the purchase of a new machine for $375,000. The firm's old machine has a

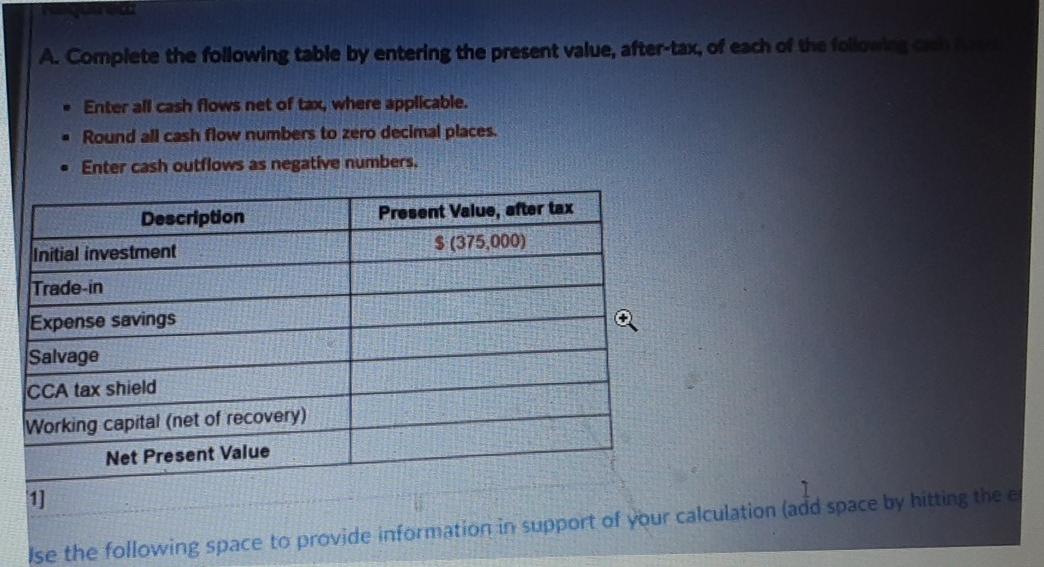

Question 4 (21 points) Saved Listen Clearview Systems Ltd. is considering the purchase of a new machine for $375,000. The firm's old machine has a book value of $50,000 but can be sold today for $20,000. The new machine will be subject to a CCA rate of 25 percent. It is expected to save an annual cash flow of $62,000 per year for 8 years through reduced fuel and maintenance expenses. The company will need to invest $12,000 in spare parts inventory (working capital) when they purchase the machine. At the end of the 8 years the company believes it can sell the machine for $40,000. Clearview Systems Ltd. has a 12 percent cost of capital and a 30 perceift tax rate. (10) A. Complete the following table by entering the present value, after-tax, of each of the follo Enter all cash flows net of tax, where applicable. Round all cash flow numbers to zero decimal places. Enter cash outflows as negative numbers, Present Value, after tax S (375,000) Description Initial investment Trade-in Expense savings Salvage CCA tax shield Working capital (net of recovery) Net Present Value 1) Ise the following space to provide information in support of your calculation (add space by hitting the e Worlding capital (not of recovery) Net Present Value Use the following space to provide information in support of your calculation (add space by baths then move on to the next question. B. Should Defence Electronics Inc. purchase the machine? Write your answer in the following spaces BOTTOM OF THE ANSWER BOX (There are no questions below this sentence.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts