Question: QUESTION 4. (24 MARKS) Consider the return generating process of three assets X, Y, and Z. Returns are explained by two uncorrelated factors, F1,t, the

QUESTION 4. (24 MARKS) Consider the return generating process of three assets X, Y, and Z. Returns are explained by two uncorrelated factors, F1,t, the investor confidence and F2,t, changes in interest rates: RX,t = -0.004 + F1,t - 2F2,t RY,t = -0.005 + 5F1,t RZ,t = 0.007 - 3F1,t + 2F2,t As a portfolio manager, you would like to replicate the performance of the well-diversified Q index, which has a factor loading of one with respect to investor confidence and a factor loading of two with respect to changes in interest rates. Assume also that the standard deviation of the first factor is 9% and of the second factor is 13%. Finally, the risk-free rate is 2%. 1. Find the expected returns and the factor betas of all three assets. (6 marks) 2. Determine the tracking portfolio of the Q index using the three risky assets above. Find its expected return and standard deviation. Interpret. (5 marks) do question two

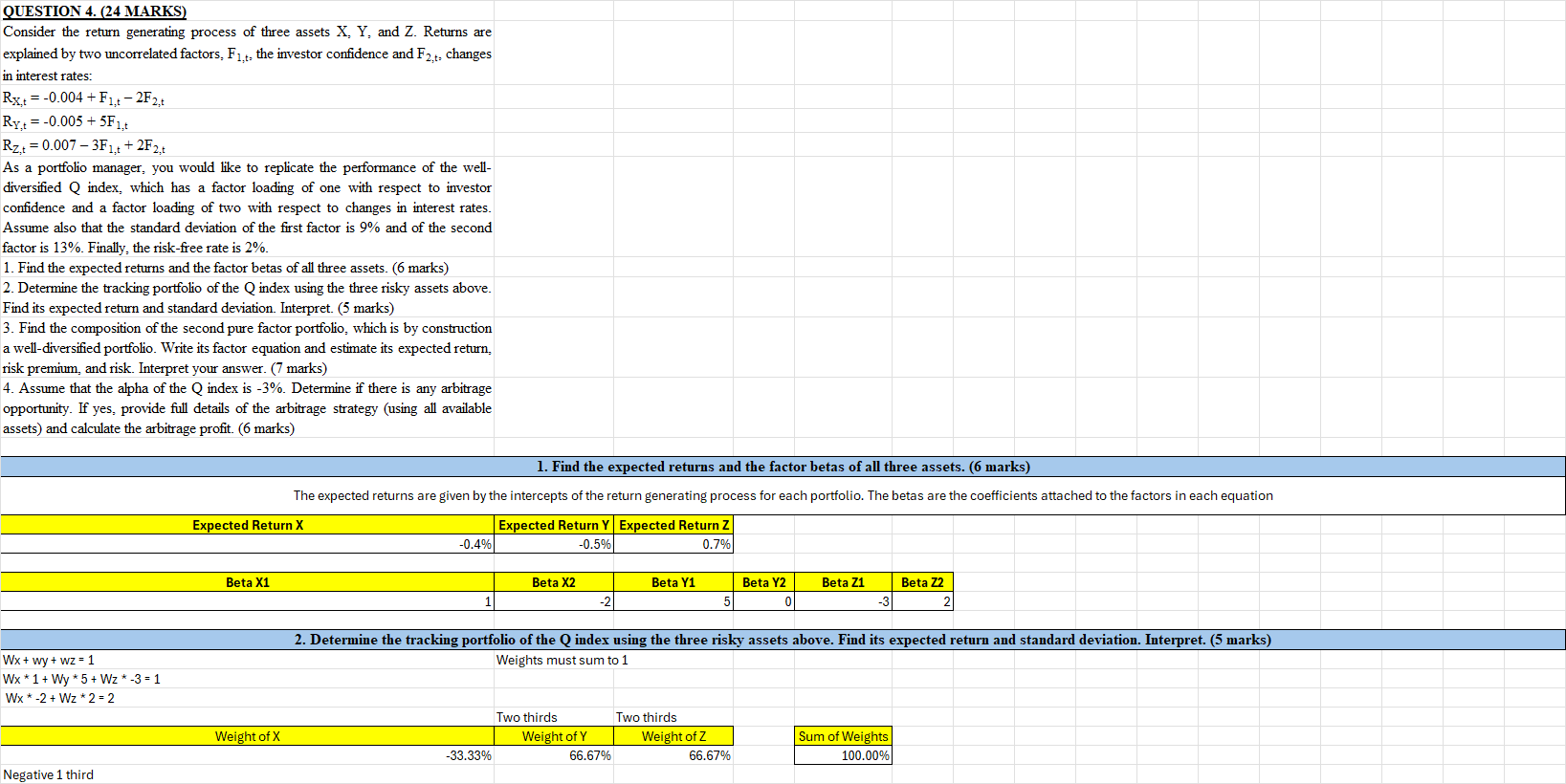

QUESTION 4. (24 MARKS) Consider the return generating process of three assets X, Y. and Z. Returns are explained by two uncorrelated factors, F . the investor confidence and Fy ;. changes in interest rates: Ry, =-0.004+F,;~2F:; Ry =-0.005 +3F Rz, =0.007-3F;, +2F;, As a portfolio manager, you would like to replicate the performance of the well- diversified Q index, which has a factor loading of one with respect to investor confidence and a factor loading of two with respect to changes in interest rates. Assume also that the standard deviation of the first factor is 9% and of the second factor is 13%. Finally, the risk-free rate is 2%. 1. Find the expected returns and the factor betas of all three assets. (6 marks) 2. Determine the tracking portfolio of the Q mdex using the three risky assets above. Find its expected return and standard deviation. Interpret. (5 marks) 3. Find the composition of the second pure factor portfolio. which is by construction a well-diversified portfolio. Write its factor equation and estimate its expected return, risk premium, and risk. Interpret your answer. (7 marks) 4. Assume that the alpha of the Q index is -3%. Determine if there is any arbitrage opportunity. If ves, provide full details of the arbitrage strategy (using all available assets) and calculate the arbitrage profit. (6 marks) 1. Find the expected returns and the factor betas of all three assets. (6 marks) The expected returns are given by the intercepts of the return generating process for each portfolio. The betas are the coefficients attached to the factors in each equation Expected Return X Expected Return Y | Expected Return Z -0.4% 0.5% 0.7% Beta X1 Beta X2 Beta Y1 Beta Y2 Beta Z1 Beta 72 1 2 5 0 3 2 2. Determine the tracking portfolio of the Q index using the three risky assets above. Find its expected return and standard deviation. Interpret. (5 marks) Wx+wy+wz=1 Weights mustsumtol Vit 1+ Wy *5+Wz*-3=1 Wx*-2+Wz*2=2 Two thirds Two thirds Weight of X Weight of Y Weightof Z Sum of Weights -33.33% 66.67% 66.67% 100.00% Negative 1 third