Question: QUESTION 4 (25 MARKS) a) Describe an ETF and explain how these funds combine the characteristics of both open end and closed-end funds in Malaysia.

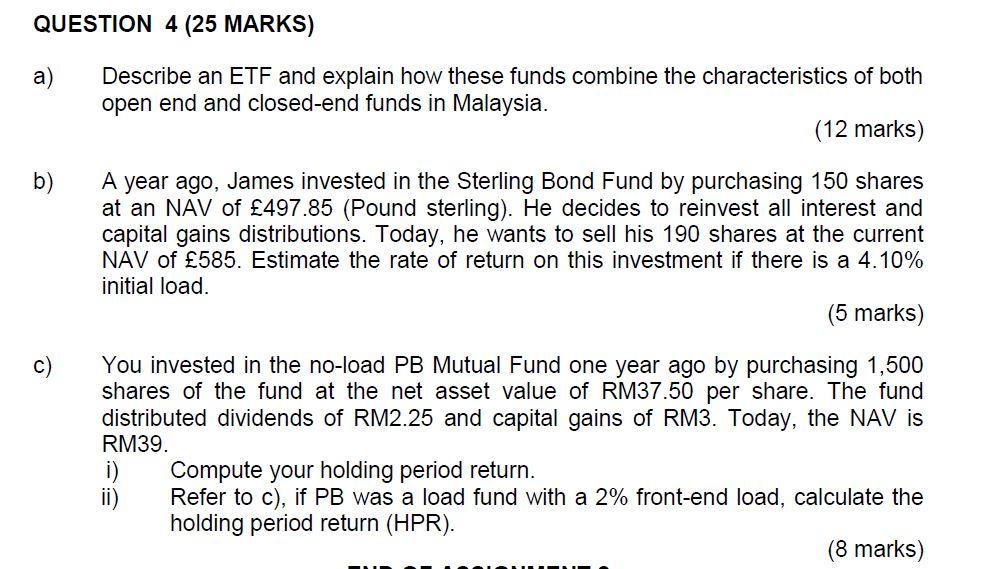

QUESTION 4 (25 MARKS) a) Describe an ETF and explain how these funds combine the characteristics of both open end and closed-end funds in Malaysia. (12 marks) b) A year ago, James invested in the Sterling Bond Fund by purchasing 150 shares at an NAV of 497.85 (Pound sterling). He decides to reinvest all interest and capital gains distributions. Today, he wants to sell his 190 shares at the current NAV of 585. Estimate the rate of return on this investment if there is a 4.10% initial load. (5 marks) c) You invested in the no-load PB Mutual Fund one year ago by purchasing 1,500 shares of the fund at the net asset value of RM37.50 per share. The fund distributed dividends of RM2.25 and capital gains of RM3. Today, the NAV is RM39. Compute your holding period return. ii) Refer to c), if PB was a load fund with a 2% front-end load, calculate the holding period return (HPR). (8 marks) QUESTION 4 (25 MARKS) a) Describe an ETF and explain how these funds combine the characteristics of both open end and closed-end funds in Malaysia. (12 marks) b) A year ago, James invested in the Sterling Bond Fund by purchasing 150 shares at an NAV of 497.85 (Pound sterling). He decides to reinvest all interest and capital gains distributions. Today, he wants to sell his 190 shares at the current NAV of 585. Estimate the rate of return on this investment if there is a 4.10% initial load. (5 marks) c) You invested in the no-load PB Mutual Fund one year ago by purchasing 1,500 shares of the fund at the net asset value of RM37.50 per share. The fund distributed dividends of RM2.25 and capital gains of RM3. Today, the NAV is RM39. Compute your holding period return. ii) Refer to c), if PB was a load fund with a 2% front-end load, calculate the holding period return (HPR). (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts