Question: Question 4 (25 Marks) a) Sam Banks a high net worth client of Investments Plus wants assistance before making his investment decision Banks needs to

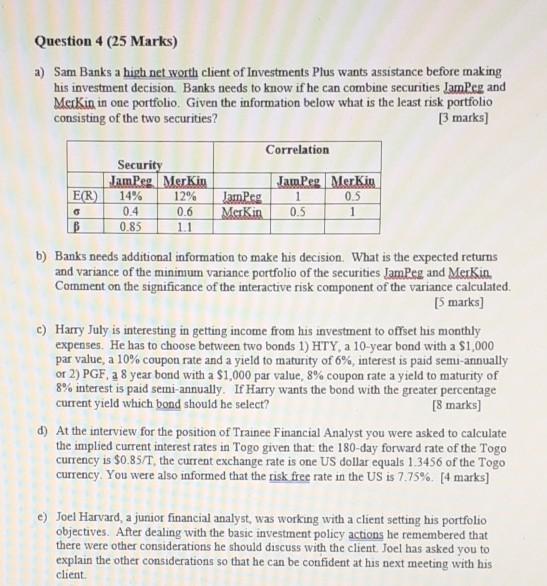

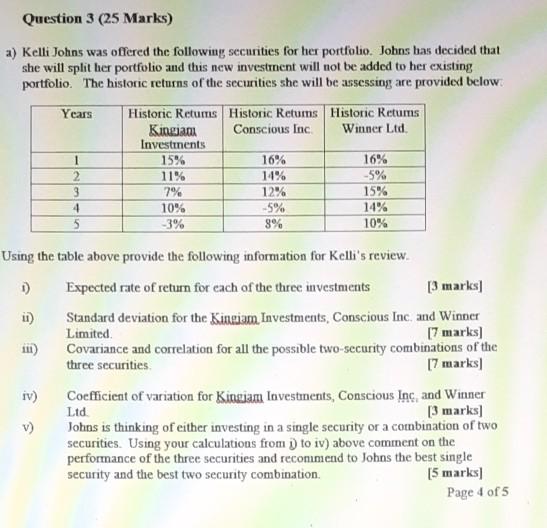

Question 4 (25 Marks) a) Sam Banks a high net worth client of Investments Plus wants assistance before making his investment decision Banks needs to know if he can combine securities JamPeg and Makin in one portfolio Given the information below what is the least risk portfolio consisting of the two securities? [3 marks) Correlation ER) 6 B Security Jam Peg Merkin 14% 12% 0.4 0.6 0.85 11 Jam Peg Merkin Jam Peg Merkio 1 0.5 0.5 1 b) Banks needs additional information to make his decision. What is the expected returns and variance of the minimum variance portfolio of the securities JamPeg and Merkio. Comment on the significance of the interactive risk component of the variance calculated. [5 marks] c) Harry July is interesting in getting income from his investment to offset his monthly expenses. He has to choose between two bonds 1) HTY, a 10-year bond with a $1,000 par value, a 10% coupon rate and a yield to maturity of 6%, interest is paid semi-annually of 2) PGF a 8 year bond with a $1,000 par value, 8% coupon rate a yield to maturity of 8% interest is paid semi-annually. If Harry wants the bond with the greater percentage current yield which bond should he select? [8 marks) d) At the interview for the position of Trainee Financial Analyst you were asked to calculate the implied current interest rates in Togo given that the 180 day forward rate of the Togo currency is $0.85/T, the current exchange rate is one US dollar equals 1.3456 of the Togo currency. You were also informed that the risk free rate in the US is 7.75% [4 marks] e) Joel Harvard, a junior financial analyst, was working with a client setting his portfolio objectives. After dealing with the basic investment policy actions be remembered that there were other considerations he should discuss with the client. Joel has asked you to explain the other considerations so that he can be confident at his next meeting with his client Question 3 (25 Marks) a) Kelli Johns was offered the following securities for her portfolio. Johns has decided that she will split her portfolio and this new investment will not be added to her existing portfolio. The historic returns of the securities she will be assessing are provided below Years Historic Retums Historic Retums Historic Retums Kingjan Conscious Inc Winner Ltd. Investments 15% 16% 16% 2 11% 14% -5% 7% 12% 15% 4 10% -5% 14% 5 -3% 8% 10% Using the table above provide the following information for Kelli's review 1) Expected rate of return for each of the three investments [3 marks) Standard deviation for the kingiam Investments, Conscious Inc and Winner Limited [7 marks) 111) Covariance and correlation for all the possible two-security combinations of the three securities [7 marks) IV) Coefficient of variation for Kinaciam Investments, Conscious Inc and Winner Ltd [3 marks) Johns is thinking of either investing in a single security or a combination of two securities. Using your calculations from ) to iv) above comment on the performance of the three securities and recommend to Johns the best single security and the best two security combination [5 marks] Page 4 of 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts