Question: Question 4 (25 marks) Consider a put option selling for $4 in which the exercise price is $60 and the price of the underlying is

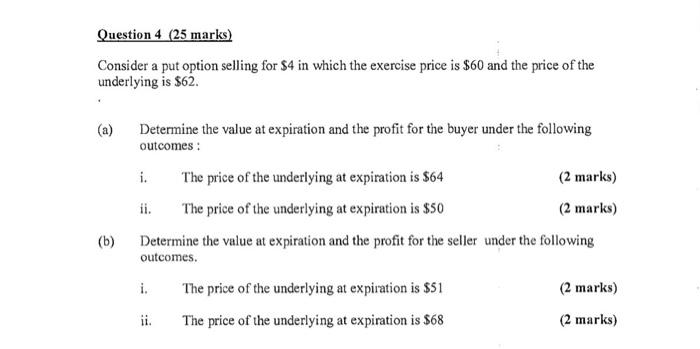

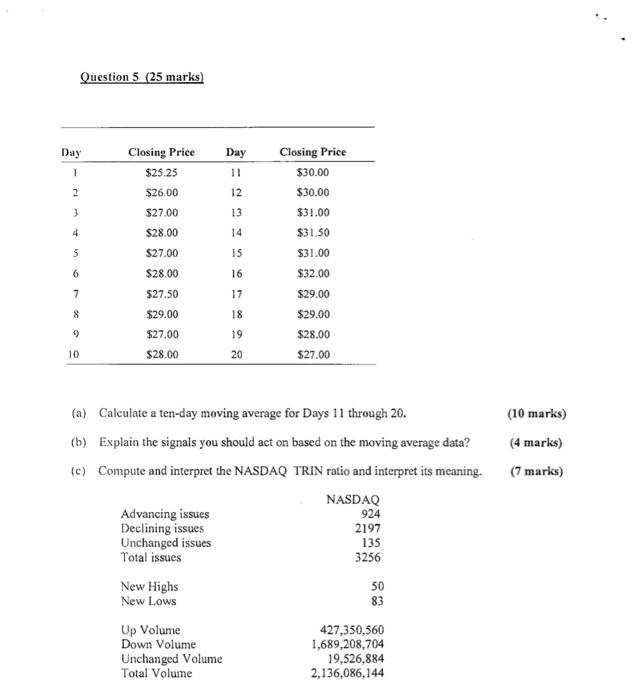

Question 4 (25 marks) Consider a put option selling for $4 in which the exercise price is $60 and the price of the underlying is $62. (a) Determine the value at expiration and the profit for the buyer under the following outcomes : i. The price of the underlying at expiration is $64 (2 marks) ii. The price of the underlying at expiration is $50 (2 marks) Determine the value at expiration and the profit for the seller under the following outcomes. i. The price of the underlying at expiration is $51 (2 marks) ii. The price of the underlying at expiration is $68 (2 marks) (b) Question 5 (25 marks) Day 1 Day 11 2 12 3 13 4 14 5 Closing Price $25.25 $26.00 $27.00 $28.00 $27.00 $28.00 $27.50 $29.00 $27.00 $28.00 IS Closing Price $30.00 $30.00 $31.00 $31.50 $31.00 $32.00 $29.00 $29.00 $28.00 $27.00 6 16 7 17 8 18 9 19 20 10 (10 marks) (4 marks) (7 marks) (a) Calculate a ten-day moving average for Days 11 through 20. (b) Explain the signals you should act on based on the moving average data? (c) Compute and interpret the NASDAQ TRIN ratio and interpret its meaning. NASDAQ Advancing issues 924 Declining issues 2197 Unchanged issues 135 Total issues 3256 New Highs New Lows 50 83 Up Volume Down Volume Unchanged Volume Total Volume 427,350,560 1,689,208,704 19,526,884 2,136,086,144

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts