Question: Question 4 (25 marks) Forever Young was a public listed company running department stores and determined to open a new department store. The initial investment

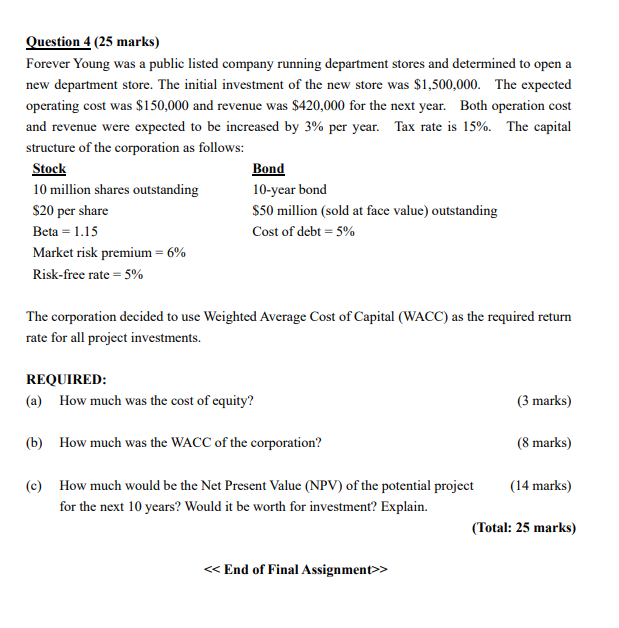

Question 4 (25 marks) Forever Young was a public listed company running department stores and determined to open a new department store. The initial investment of the new store was $1,500,000. The expected operating cost was $150,000 and revenue was $420,000 for the next year. Both operation cost and revenue were expected to be increased by 3% per year. Tax rate is 15%. The capital structure of the corporation as follows: Stock Bond 10 million shares outstanding 10-year bond $20 per share $50 million (sold at face value) outstanding Beta = 1.15 Cost of debt = 5% Market risk premium = 6% Risk-free rate = 5% The corporation decided to use Weighted Average Cost of Capital (WACC) as the required return rate for all project investments. REQUIRED: (a) How much was the cost of equity? (3 marks) (b) How much was the WACC of the corporation? (8 marks) (c) How much would be the Net Present Value (NPV) of the potential project (14 marks) for the next 10 years? Would it be worth for investment? Explain. (Total: 25 marks) End of Final Assignment>> Question 4 (25 marks) Forever Young was a public listed company running department stores and determined to open a new department store. The initial investment of the new store was $1,500,000. The expected operating cost was $150,000 and revenue was $420,000 for the next year. Both operation cost and revenue were expected to be increased by 3% per year. Tax rate is 15%. The capital structure of the corporation as follows: Stock Bond 10 million shares outstanding 10-year bond $20 per share $50 million (sold at face value) outstanding Beta = 1.15 Cost of debt = 5% Market risk premium = 6% Risk-free rate = 5% The corporation decided to use Weighted Average Cost of Capital (WACC) as the required return rate for all project investments. REQUIRED: (a) How much was the cost of equity? (3 marks) (b) How much was the WACC of the corporation? (8 marks) (c) How much would be the Net Present Value (NPV) of the potential project (14 marks) for the next 10 years? Would it be worth for investment? Explain. (Total: 25 marks) End of Final Assignment>>

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts