Question: QUESTION 4 (25 MARKS) Topex Sdn Bhd's management is always looking for ways to improve productivity and efficiency. This is the more important in view

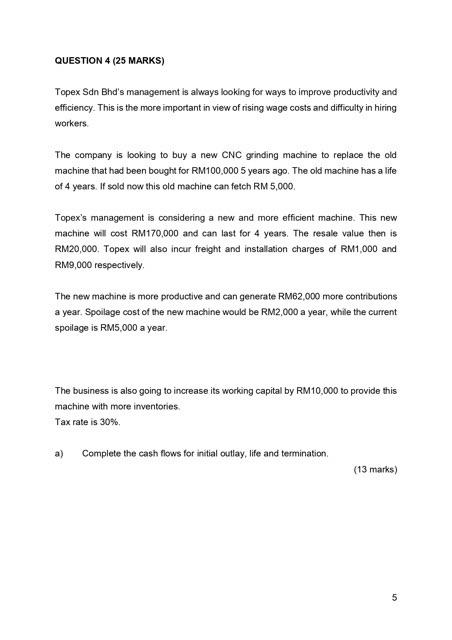

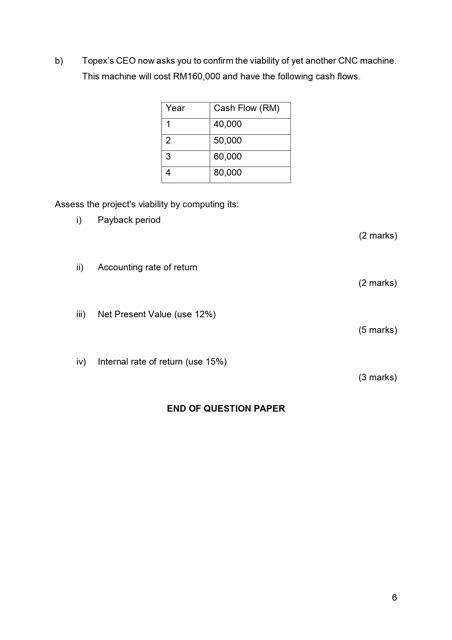

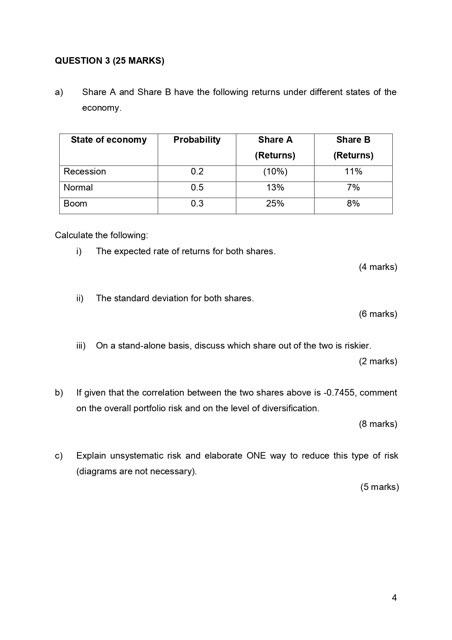

QUESTION 4 (25 MARKS) Topex Sdn Bhd's management is always looking for ways to improve productivity and efficiency. This is the more important in view of rising wage costs and difficulty in hiring workers. The company is looking to buy a new CNC grinding machine to replace the old machine that had been bought for RM100,000 5 years ago. The old machine has a life of 4 years. If sold now this old machine can fetch RM 5,000 . Topex's management is considering a new and more efficient machine. This new machine will cost RM170,000 and can last for 4 years. The resale value then is RM20,000. Topex will also incur freight and installation charges of RM1,000 and RM9,000 respectively. The new machine is more productive and can generate RMB2,000 more contributions a year. Spoilage cost of the new machine would be RM2,000 a year, while the current spoilage is RM5,000 a year. The business is also going to increase its working capital by RM10,000 to provide this machine with more inventories. Tax rate is 30%. a) Complete the cash flows for initial outlay, life and termination. (13 marks) b) Topex's CEO now asks you to confirm the viability of yet another CNC machine. This machine will cost RM160,000 and have the following cash flows. Assess the project's viabisty by computing its: i) Payback period (2 marks) ii) Accounting rate of return (2 marks) iii) Net Present Value (use 12\%) (5 marks) iv) Internal rate of return (use 15\%) (3 marks) a) Share A and Share B have the following returns under different states of the economy. Calculate the following: i) The expected rate of returns for both shares. (4 marks) ii) The standard deviation for both shares. (6 marks) iii) On a stand-alone basis, discuss which share out of the two is riskier. (2 marks) b) If given that the correlation between the two shares above is 0.7455, comment on the overall portfolio risk and on the level of diversification. (8 marks) c) Explain unsystematic risk and elaborate ONE way to reduce this type of risk (diagrams are not necessary)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts