Nexcare (Ltd) operate a number of car washes and auto valet services. The company has experienced...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

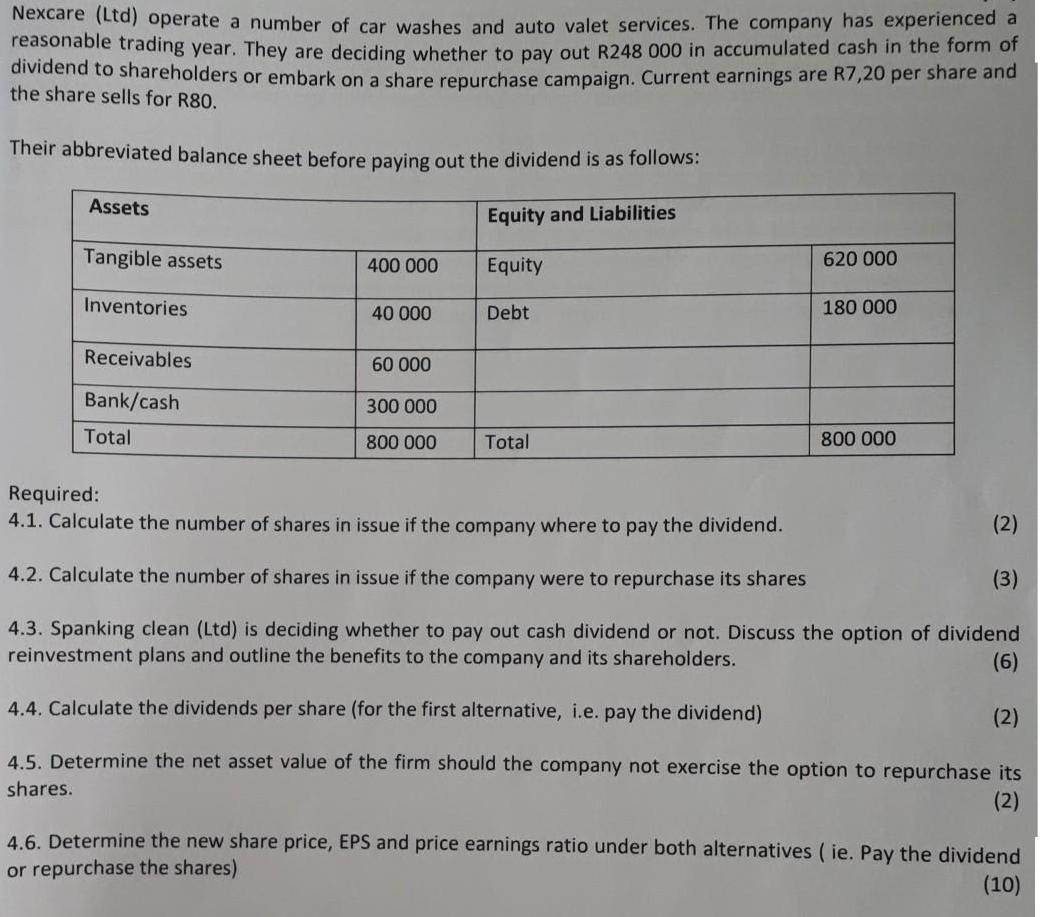

Nexcare (Ltd) operate a number of car washes and auto valet services. The company has experienced a reasonable trading year. They are deciding whether to pay out R248 000 in accumulated cash in the form of dividend to shareholders or embark on a share repurchase campaign. Current earnings are R7,20 per share and the share sells for R80. Their abbreviated balance sheet before paving out the dividend is as follows: Assets Equity and Liabilities Tangible assets 400 000 Equity 620 000 Inventories 40 000 Debt 180 000 Receivables 60 000 Bank/cash 300 000 Total 800 000 Total 800 000 Required: 4.1. Calculate the number of shares in issue if the company where to pay the dividend. (2) 4.2. Calculate the number of shares in issue if the company were to repurchase its shares (3) 4.3. Spanking clean (Ltd) is deciding whether to pay out cash dividend or not. Discuss the option of dividend reinvestment plans and outline the benefits to the company and its shareholders. (6) 4.4. Calculate the dividends per share (for the first alternative, i.e. pay the dividend) (2) 4.5. Determine the net asset value of the firm should the company not exercise the option to repurchase its shares. (2) 4.6. Determine the new share price, EPS and price earnings ratio under both alternatives ( ie. Pay the dividend or repurchase the shares) (10) Nexcare (Ltd) operate a number of car washes and auto valet services. The company has experienced a reasonable trading year. They are deciding whether to pay out R248 000 in accumulated cash in the form of dividend to shareholders or embark on a share repurchase campaign. Current earnings are R7,20 per share and the share sells for R80. Their abbreviated balance sheet before paving out the dividend is as follows: Assets Equity and Liabilities Tangible assets 400 000 Equity 620 000 Inventories 40 000 Debt 180 000 Receivables 60 000 Bank/cash 300 000 Total 800 000 Total 800 000 Required: 4.1. Calculate the number of shares in issue if the company where to pay the dividend. (2) 4.2. Calculate the number of shares in issue if the company were to repurchase its shares (3) 4.3. Spanking clean (Ltd) is deciding whether to pay out cash dividend or not. Discuss the option of dividend reinvestment plans and outline the benefits to the company and its shareholders. (6) 4.4. Calculate the dividends per share (for the first alternative, i.e. pay the dividend) (2) 4.5. Determine the net asset value of the firm should the company not exercise the option to repurchase its shares. (2) 4.6. Determine the new share price, EPS and price earnings ratio under both alternatives ( ie. Pay the dividend or repurchase the shares) (10)

Expert Answer:

Answer rating: 100% (QA)

41 Number of shares equity share price 62000080 7750 shares 42 Buying back shares reduces available ... View the full answer

Related Book For

Auditing and Assurance Services

ISBN: 978-0077862343

6th edition

Authors: Timothy Louwers, Robert Ramsay, David Sinason, Jerry Straws

Posted Date:

Students also viewed these economics questions

-

As a portfolio manager, you are deciding whether to add Crico stock to your portfolio. Crico Corporation is a publicly listed real estate investment trust. The current trading price of Cricos stock...

-

Find the values of x for which the function is continuous f (x) = 12-11 0 O All real numbers O None of these O (-, 1) U (1, 0)

-

Earnings Per Share (EPS) Answer Key Year 1 EPS $2.00 per share Year 2 EPS $1.09 per share Year 1 reported in Year 2 $1.00 per share Company had 202,000 CS shares O/S at 1/1/Y1. Following is info for...

-

Consider an extendable hash structure where buckets can hold 3 search key values. The entries with the key values listed below are inserted in the following order: 57, 28, 26, 98, 38, 79, 7, 109, 30...

-

Suppose that you have a "black-box" worst-case linear-time median subroutine. Give a simple, linear-time algorithm that solves the selection problem for an arbitrary order statistic.

-

The following observations are lifetimes (days) subsequent to diagnosis for individuals suffering from blood cancer a. Can a confidence interval for true average lifetime be calculated without...

-

E 6-5 General questions [Based on AICPA] 1. On January 1, 2016, Pam Company sold equipment to its wholly owned subsidiary, Sun Company, for $1,800. The equipment cost Pam $2,000. Accumulated...

-

The items that follow are from the Income Statement columns of winters Repair Shops work sheet for the year ended December 31, 2014. Prepare journal entries to close the revenue, expense, Income...

-

Kishori owns a rental property; her tenant, Daria, paid $1,200 per month in rent, except for March, April, and May. Daria did extensive electrical work and repaired two windows in the house in...

-

Determine the maximum load that can be allowed on the 450 mm diameter pile shown in Figure P12.9, with a factor of safety of 3. Use the a method and Table 12.11 for determining the skin friction and...

-

Holmes Cleaning Service began operation on January 1, Year 1. The company experienced the following events for its first year of operations: Events Affecting Year 1: 1. Provided $170,000 of cleaning...

-

Lazlo s estimates uncollectible accounts to be 0 . 9 % of sales. Its year - end unadjusted trial balance shows Accounts Receivable of $ 1 1 2 , 5 0 0 and sales of $ 9 6 5 , 0 0 0 . If Lazlo s uses...

-

Identify one or two of the best and one or two of the worst work teams on which you served as a member. 1. Identify the top three to five factors that made the team the best or the worst in terms of...

-

ColorCoder is a HousePaint Shop which supplies currently two types of house paints, namely, alpha and beta house paints. The shop is planning to sell a primer (paint base) and the needed paint...

-

which department adds value to a product or service that is observable by a customer?

-

Using Figure 14.1, answer the following questions: a. What was the settle price for July 2022 coffee futures on this date? What is the total dollar value of this contract at the close of trading for...

-

Hi can anyone answer this for me? Statement of stockholders' equity Brenda Tooley owns and operates Speedy Delivery Services. On January 1, 2017, Common Stock had a balance of $30,000, and Retained...

-

Write a while loop that uses an explicit iterator to accomplish the same thing as Exercise 7.3. Exercise 7.3. Write a for-each loop that calls the addInterest method on each BankAccount object in a...

-

What feature of the acquisition and expenditure control would be expected to prevent an employee from embezzling cash by creating fictitious vouchers?

-

A type of sampling application in which a relatively small initial sample is examined and decisions regarding expanding that sample are based on the results of this initial sample is known as a....

-

What are the goals of dual- direction testing regarding an audit of the accounts receivable and cash collection system?

-

An experiment utilizing a randomized block design was conducted to compare the mean responses for four treatments, A, B, C, and D. The treatments were randomly assigned to the four experimental units...

-

A new dental bonding agent. Refer to the Trends in Biomaterials & Artificial Organs (Jan. 2003) study of a bonding adhesive for teeth, presented in Exercise 8.154 (p. 455). Recall that the adhesive...

-

What is the difference between a design study and an observational LO4 study?

Study smarter with the SolutionInn App