Question: Question 4 (2.5 points) According to the CAPM, the expected rate of return of a portfolio with a beta of 1.0 and an alpha of

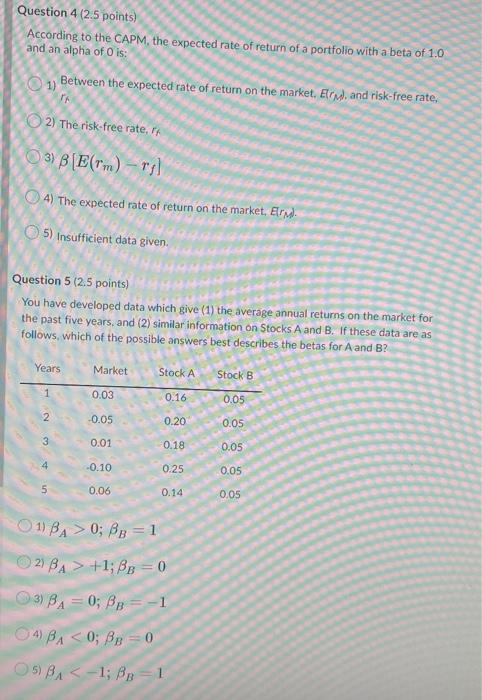

Question 4 (2.5 points) According to the CAPM, the expected rate of return of a portfolio with a beta of 1.0 and an alpha of Ois: 1) Between the expected rate of return on the market. Eral and risk-free rate, 2) The risk-free rate, la 3) B[E(Tm) ry! 4) The expected rate of return on the market, Elr. 5) Insufficient data given. Question 5 (2.5 points You have developed data which give (1) the average annual returns on the market for the past five years, and (2) similar information on Stocks A and B. If these data are as follows, which of the possible answers best describes the betas for A and B? Years Market Stock A Stock B 1 0.03 0.16 0.05 2 -0.05 0.20 0.05 3 0.01 0.18 0.05 4 -0.10 0.25 0.05 5 5 0.06 0.14 0.05 11 BA > 0; BB = 1 2) BA > +1; BB = 0 3) BA = 0; BB = -1 4) BA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts