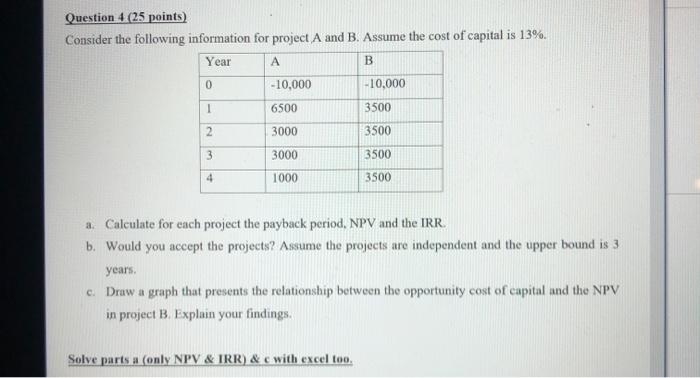

Question: Question 4 (25 points) Consider the following information for project A and B. Assume the cost of capital is 13%. Year A B 0 -10,000

Question 4 (25 points) Consider the following information for project A and B. Assume the cost of capital is 13%. Year A B 0 -10,000 -10,000 1 6500 3500 2 3000 3500 3 3000 3500 4 1000 3500 a. Calculate for each project the payback period. NPV and the IRR. b. Would you accept the projects? Assume the projects are independent and the upper bound is 3 years c. Draw a graph that presents the relationship between the opportunity cost of capital and the NPV in project B. Explain your findings. Solve parts at (only NPV & IRR) & c with excel too

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts