Question: Question 4: (25 points) SHOW YOUR CALCULATION Calculate the GDS and TDS. (20 points) Calculate the land transfer tax owed to the city. GDS__________________________________ TDS__________________________________

Question 4: (25 points) SHOW YOUR CALCULATION

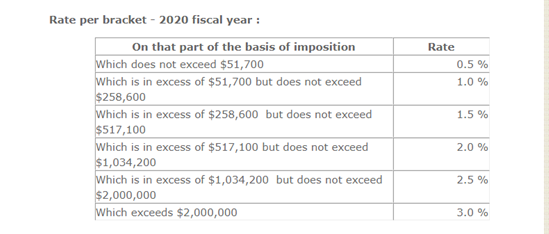

Calculate the GDS and TDS. (20 points) Calculate the land transfer tax owed to the city.

GDS__________________________________

TDS__________________________________

Land transfer tax: $________________________

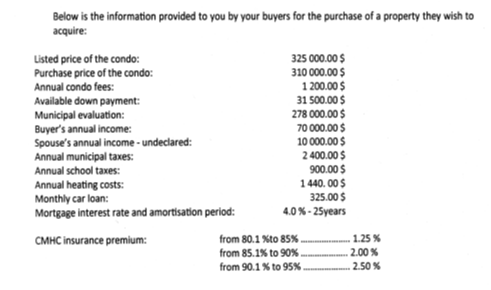

Below is the information provided to you by your buyers for the purchase of a property they wish to acquire: Listed price of the condo: 325 000.00 $ Purchase price of the condo: 310 000.00 $ Annual condo fees: 1 200.00 $ Available down payment: 31 500.00 $ Municipal evaluation: 278 000.00 $ Buyer's annual income: 70 000.00 $ Spouse's annual income - undeclared: 10000.00 $ Annual municipal taxes: 2400.00 $ Annual school taxes: 900.00 $ Annual heating costs: 1 440.00 $ Monthly car loan: 325.00 $ Mortgage Interest rate and amortisation period: 4.0 %-25years CMHC Insurance premium: from 80.1 Xto 85% 1.25 % from 85.1% to 90% 2.00% from 90.1% to 95% 2.50 % Rate 0.5 % 1.0 % Rate per bracket - 2020 fiscal year : On that part of the basis of imposition Which does not exceed $51,700 Which is in excess of $51,700 but does not exceed $258,600 Which is in excess of $258,600 but does not exceed $517,100 Which is in excess of $517,100 but does not exceed $1,034,200 Which is in excess of $1,034,200 but does not exceed $2,000,000 Which exceeds $2,000,000 1.5 % 2.0 % 2.5 % 3.0 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts