Question: Question 4 (25marks) 4.1. Maputo Development Bark has a potfolio of two projects worth R10 millon. One project tas an investment ef Rimilion. (10marks) expected

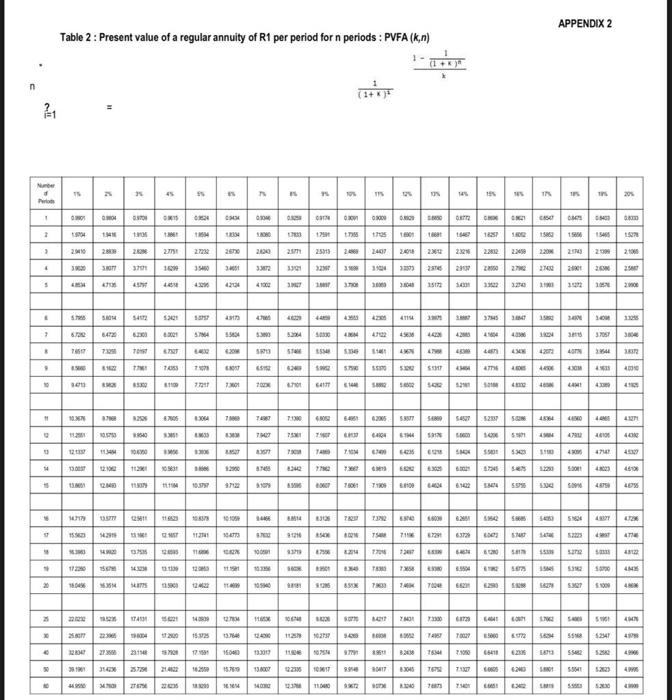

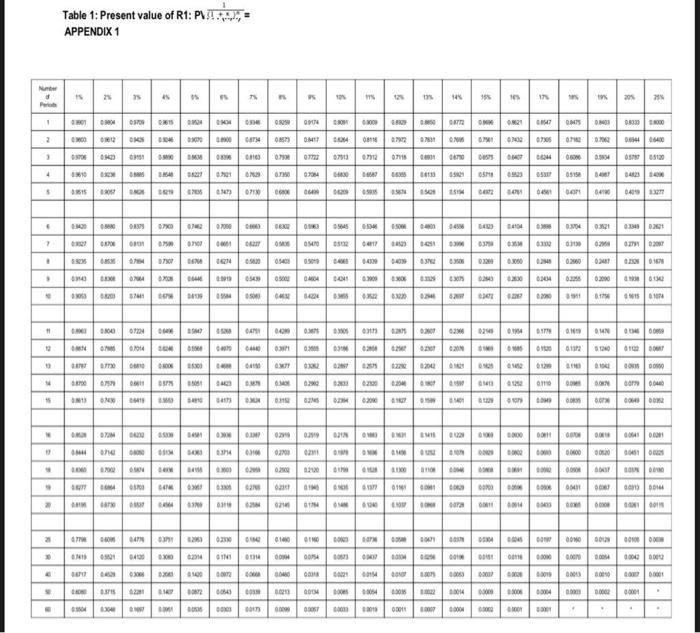

Question 4 (25marks) 4.1. Maputo Development Bark has a potfolio of two projects worth R10 millon. One project tas an investment ef Rimilion. (10marks) expected retum of 9% and a standard deviation of 15%. The cher project has an investment of R.4milion tas an expected return of 4% and a standard deviation of 11%, it is detemined that the covarince becueen the two proiects is 4%. Determine fle expected retum and standard deviation of the portblio. 4.2. Distinguish betweet proipct portolio and financial portfolis (5marks) 4.3. Hecter Gaming Company AGC) is an educational gaming cemoany spectalifing in young children's educational games. HGC (10mans) has just completed thei fouth year of operation. The conouny is commitied lo launching 5 new nonster thadis versions each Apri to take advantage of the summer leason. HCC invited 2 finance professors to cover capits budgeting. explaining how to calculate the NPV and IRR, and stated that these should be used to scteen poliential proiects and many other innorations that HGC bring into the objectires and strategic plast. In the O-and-A session, the EO Wison, the Hector Gaming Company's CFO and the 2 government oflicials trom the Minisiry of finance sffice arpued in twour of nonifnancial orcera in selecting and ranking projects and vehemertly repcted the NPV and IPR approsch. (Fundarnental analysis, Palat 2019. 233) Give practical recommendations in favour of the CFO and the 2 povernment elficials it soliciting tor non-financial criboria when selecting and ranking potential projects. APPENDIX 2 Table 2 : Present value of a regular annuity of R1 per period for n periods : PVFA (k,n) (1+x)21x1(1+x)n1 APPENDIX 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts