Question: Question 4 | 25marks Kofi is considering retiring from active service at age 65 with GH5,000,000 in his retirement investment account. Now, Kofi is 35

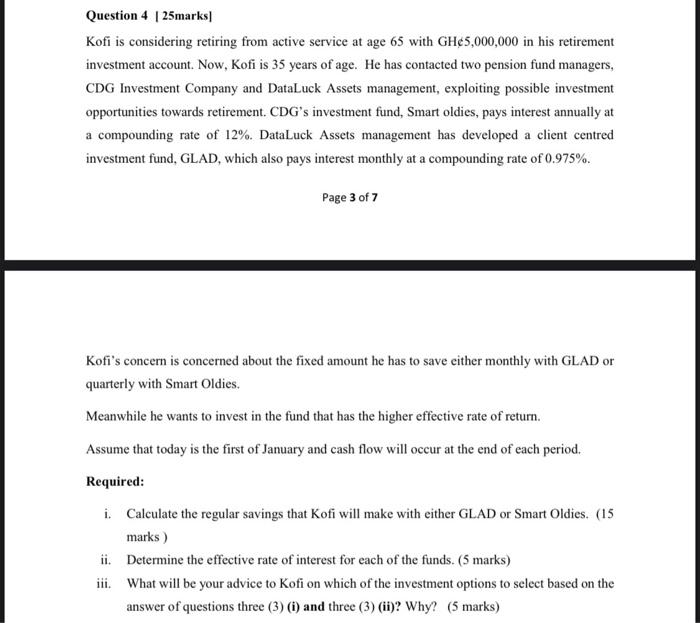

Question 4 | 25marks Kofi is considering retiring from active service at age 65 with GH5,000,000 in his retirement investment account. Now, Kofi is 35 years of age. He has contacted two pension fund managers, CDG Investment Company and DataLuck Assets management, exploiting possible investment opportunities towards retirement. CDG's investment fund, Smart oldies, pays interest annually at a compounding rate of 12%. DataLuck Assets management has developed a client centred investment fund, GLAD, which also pays interest monthly at a compounding rate of 0.975%. Page 3 of 7 Kofi's concern is concerned about the fixed amount he has to save either monthly with GLAD or quarterly with Smart Oldies. Meanwhile he wants to invest in the fund that has the higher effective rate of return. Assume that today is the first of January and cash flow will occur at the end of each period. Required: i. Calculate the regular savings that Kofi will make with either GLAD or Smart Oldies. (15 marks) ii. Determine the effective rate of interest for each of the funds. (5 marks) iii. What will be your advice to Kofi on which of the investment options to select based on the answer of questions three (3) (i) and three (3) (ii)? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts