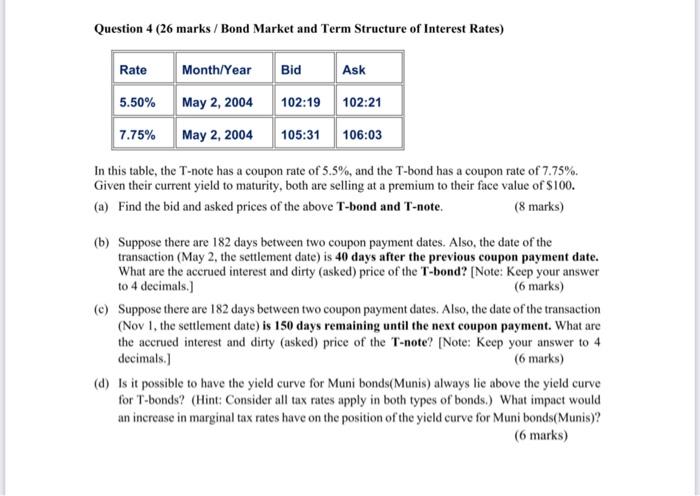

Question: Question 4 (26 marks / Bond Market and Term Structure of Interest Rates) Rate Month/Year Bid Ask 5.50% May 2, 2004 102:19 102:21 7.75% May

Question 4 (26 marks / Bond Market and Term Structure of Interest Rates) Rate Month/Year Bid Ask 5.50% May 2, 2004 102:19 102:21 7.75% May 2, 2004 105:31 106:03 In this table, the T-note has a coupon rate of 5.5%, and the T-bond has a coupon rate of 7.75%. Given their current yield to maturity, both are selling at a premium to their face value of $100. (a) Find the bid and asked prices of the above T-bond and T-note. (8 marks) (b) Suppose there are 182 days between two coupon payment dates. Also, the date of the transaction (May 2, the settlement date) is 40 days after the previous coupon payment date. What are the accrued interest and dirty asked) price of the T-bond? (Note: Keep your answer to 4 decimals.) (6 marks) (e) Suppose there are 182 days between two coupon payment dates. Also, the date of the transaction (Nov 1, the settlement date) is 150 days remaining until the next coupon payment. What are the accrued interest and dirty (asked) price of the T-note? (Note: Keep your answer to 4 decimals.) (6 marks) (d) Is it possible to have the yield curve for Muni bonds(Munis) always lic above the yield curve for T-bonds? (Hint: Consider all tax rates apply in both types of bonds.) What impact would an increase in marginal tax rates have on the position of the yield curve for Muni bonds(Munis)? (6 marks) Question 4 (26 marks / Bond Market and Term Structure of Interest Rates) Rate Month/Year Bid Ask 5.50% May 2, 2004 102:19 102:21 7.75% May 2, 2004 105:31 106:03 In this table, the T-note has a coupon rate of 5.5%, and the T-bond has a coupon rate of 7.75%. Given their current yield to maturity, both are selling at a premium to their face value of $100. (a) Find the bid and asked prices of the above T-bond and T-note. (8 marks) (b) Suppose there are 182 days between two coupon payment dates. Also, the date of the transaction (May 2, the settlement date) is 40 days after the previous coupon payment date. What are the accrued interest and dirty asked) price of the T-bond? (Note: Keep your answer to 4 decimals.) (6 marks) (e) Suppose there are 182 days between two coupon payment dates. Also, the date of the transaction (Nov 1, the settlement date) is 150 days remaining until the next coupon payment. What are the accrued interest and dirty (asked) price of the T-note? (Note: Keep your answer to 4 decimals.) (6 marks) (d) Is it possible to have the yield curve for Muni bonds(Munis) always lic above the yield curve for T-bonds? (Hint: Consider all tax rates apply in both types of bonds.) What impact would an increase in marginal tax rates have on the position of the yield curve for Muni bonds(Munis)? (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts