Question: Question 4: (26 marks) One Hawk Ltd. is evaluating a project on purchasing new tomation equipment to improve its production capacity. This project would require

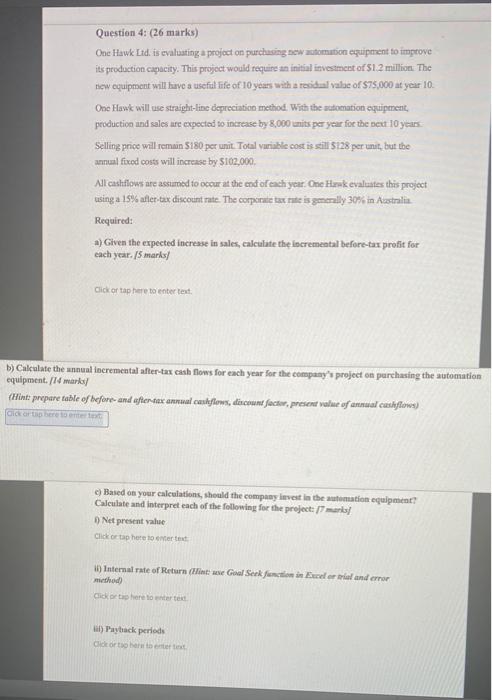

Question 4: (26 marks) One Hawk Ltd. is evaluating a project on purchasing new tomation equipment to improve its production capacity. This project would require an initial investment of $1.2 million. The new equipment will have a useful life of 10 years with a residual value of $75,000 at year 10 Onc Hawk will use straight-line depreciation method. With the stomation equipment, production and sales are expected to increase by 8,000 units per year for the next 10 years Selling price will remain 5180 per unit. Total variable cost is still 5128 per unit, but the annual fixed costs will increase by $102,000 All cashflows are assumed to occur at the end of each year. One Hank evaluates this project using a 15% atler-tax discount rate. The corporate tax rate is gmerally 39% in Australia Required: a) Given the expected increase in sales, calculate the incremental before-tex profit for cach year. 15 marks/ Click or tap here to enter text b) Calculate the annual incremental after-tax cash flows for each year for the company's project on purchasing the automation equipment. 14 mars (Hint: prepare table of before and after-tax annual conteflows, discount factor, present value of annual cashflows) Gitar c) Based on your calculations, should the company event in the nation equipment? Calculate and interpret each of the following for the project: 17 mars Net present value Click or tap here to enter that b) Internal rate of Return (neuse Guel Serk function in Excel or trial and error method) Click to her own text l) Payback periods do threat

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts