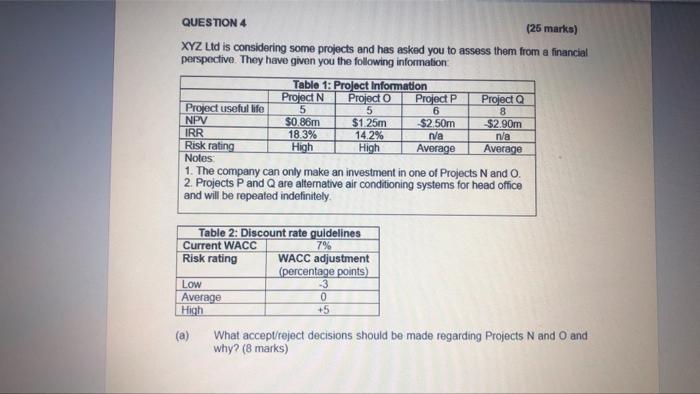

Question: QUESTION 4 (26 marks) XYZ Uld is considering some projects and has asked you to assess them from a financial perspective. They have given you

QUESTION 4 (26 marks) XYZ Uld is considering some projects and has asked you to assess them from a financial perspective. They have given you the following information: Table 1: Project Information Project N Project O Project P Project Project useful life NPV $0.86m $1.25m $2.50m $2.90m IRR 18.3% 14.2% wa n/a Risk rating High High Average Average Notes 1. The company can only make an investment in one of Projects N and O. 2. Projects P and Q are alternative air conditioning systems for head office and will be repeated indefinitely 5 5 6 8 Table 2: Discount rate guidelines Current WACC 7% Risk rating WACC adjustment (percentage points) Low 3 Average 0 High +5 (a) What accept/reject decisions should be made regarding Projects N and O and why? (8 marks) Page bor (b) What discount rate(s) should have been used in the analysis of Projects N and 0? (3 marks) (c) XYZ is a very large listed company with access to capital markets, yet managers state that the reason an investment can be made in only one of Projects N and O is due to a limit in the capital budget. What is the name given to such a situation? (3 marks) d (d) Why would no IRR be available for Projects P and Q? (3 marks) (e) What accept/reject decisions should be made regarding Projects P and Q and why? (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts