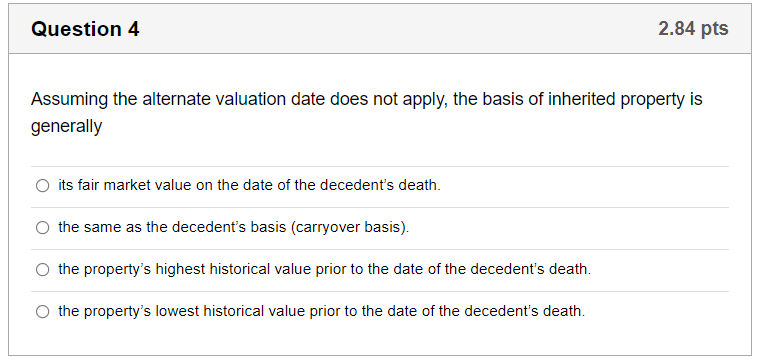

Question: Question 4 2.84 pts Assuming the alternate valuation date does not apply, the basis of inherited property is generally {3 its fair market value on

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts