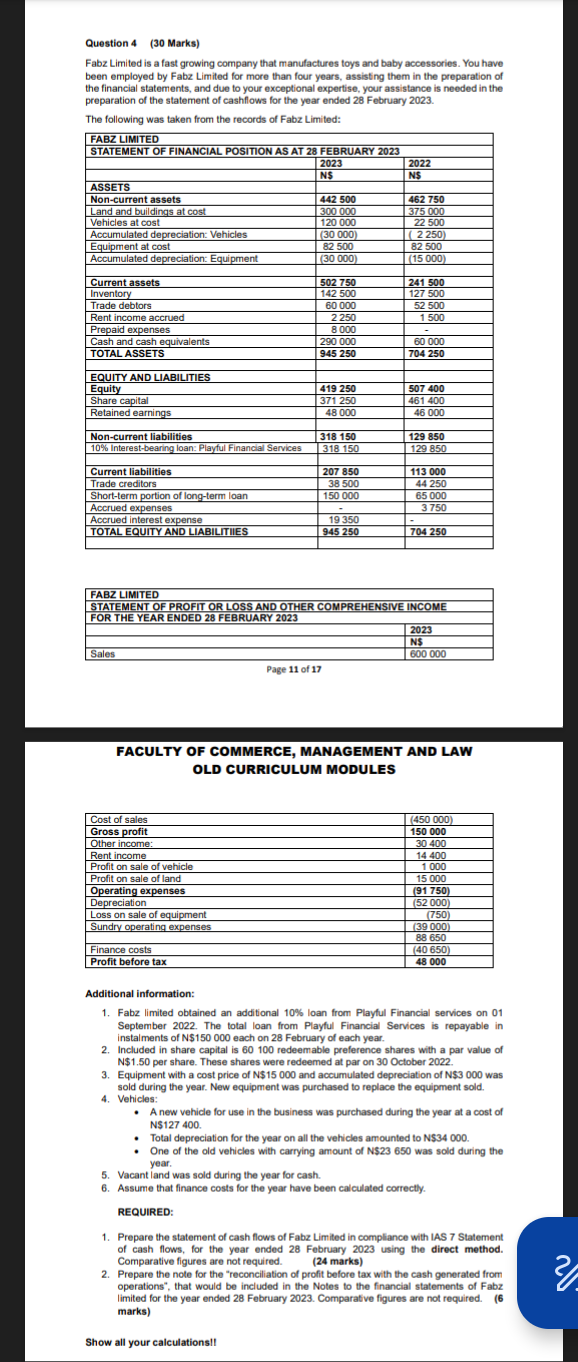

Question: Question 4 ( 3 0 Marks ) Fabz Limited is a fast growing company that manufactures toys and baby accessories. You havebeen employed by Fabz

Question MarksFabz Limited is a fast growing company that manufactures toys and baby accessories. You havebeen employed by Fabz Limited for more than four years, assisting them in the preparation ofthe financial statements, and due to your exceptional expertise. your assistance is needed in thepreparation of the statement of cashflows for the year ended February The following was taken from the records of Fabz Limi ted:FARZ LMITEDSTATEMENT OF FINANCIAL POSITION AS AT FEBRUARY ASSETSNoncurrent assetsald and buldings at costAccumulated depreciation: VehiclesEquipment at costAccurmulated depreciation: EquipmentCurrent assetsnventoryncome aCcruedPrepakd expensesCash and cash equivalentsTOTALAEQUITY AND LIABILITIESEquityNonccurrent liabilitiesd earningsCurrent liabilitiescreditorsAccrued expensesSalesAccruedinterestARILITHESTOTAL EQUITY AND Ltion of longterm loan Interestbearing l Playful Financial Services nrofitOther incoRent incomecomeOperating expensesDepreciationof equipmentFinance costsProfit before taxAdditional information:vearfoREQUIRED:Page of Vacant land was sold during the year for cashComparatilve figures are not requredShow all your calculations!!STATEMENT OF PROFIT OR LOSS AND OTHERCOMPREHENSIVE INCOMEFOR THE YEAR ENDED FEBRUARY l theTTFACULTY OF COMMERCE, MANAGEMENT AND LAWOLD CURRICULUM MODULESn Fabz limited obtained an addiional loan from Playful Financial services on Tinstalments of NS each on Fehrua of erces repayatble in Included in share capital is redeemable preference shares with a par value ofN$ per share. These shares were redeemed at par on October Equipment with a cost price of N$ and accumulated depreciation of N$ wasreptace he equipment sold.Vehees:a ew equipment was purcT A new vehicle for use in the business was purchased during the year at a cost ofN$ Assume that finance costs for the year have been calculated correctly.to N$nden amunt of Ns was sold during theCarryin atou Prepare the statement of cash flows of Fabz Limited in compliance with lAS Statement Prepare the note for the "reconciliation of profit before tax with the cash generated fromoperations", that would be included in the Notes to the financial statements of Fabzlimited for the year ended February Comparative figures are not required. marksmg the direct method.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock