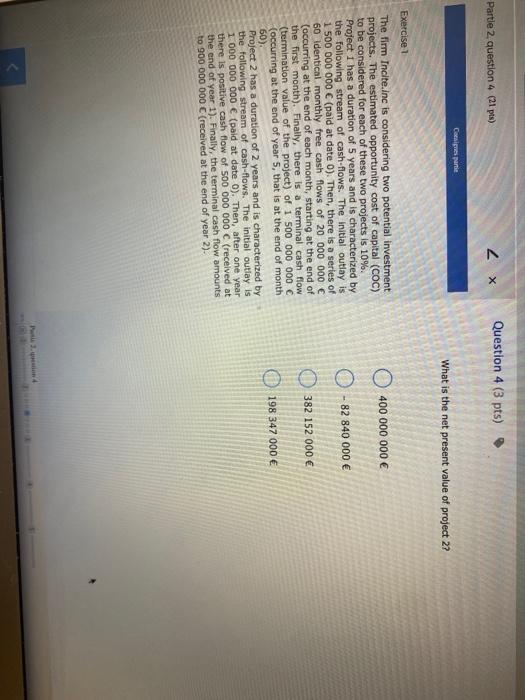

Question: Question 4 (3 pts) Partle 2 question 4 (21 pts) Lx Casiges prie What is the net present value of project 2? Exercise 1 400

Question 4 (3 pts) Partle 2 question 4 (21 pts) Lx Casiges prie What is the net present value of project 2? Exercise 1 400 000 000 0 - 82 840 000 0 382 152 000 The firm Incite.inc is considering two potential investment projects. The estimated opportunity cost of capital (COC) to be considered for each of these two projects is 10%. Project 1 has a duration of 5 years and is characterized by the following stream of cash-flows. The initial outlay is 1 500 000 000 (paid at date 0). Then, there is a series of 60 identical monthly free cash flows of 20 000 000 (occurring at the end of each month, starting at the end of the first month). Finally, there is a terminal cash flow (termination value of the project) of 1 500 000 000 (occurring at the end of year 5, that is at the end of month 60) Project 2 has a duration of 2 years and is characterized by the following stream of cash-flows. The initial outlay is 1 000 000 000 (paid at date 0). Then, after one year there is positive cash flow of 500 000 000 C (received at the end of year 1). Finally, the terminal cash flow amounts to 900 000 000 C (received at the end of year 2). 198 347 000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts