Question: Question 4 3 pts Problem 4 (3 points) A trader creates a long strangle strategy by purchasing a call option with a strike price of

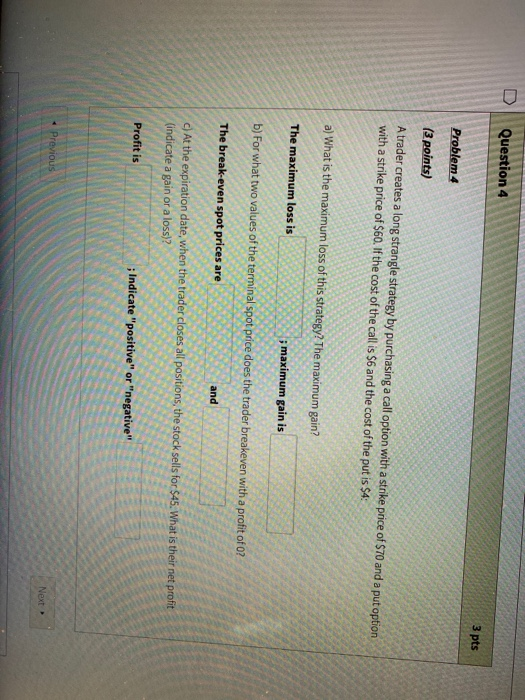

Question 4 3 pts Problem 4 (3 points) A trader creates a long strangle strategy by purchasing a call option with a strike price of $70 and a put option with a strike price of $60. If the cost of the call is $6 and the cost of the put is $4: a) What is the maximum loss of this strategy? The maximum gain? The maximum loss is maximum gain is b) For what two values of the terminal spot price does the trader breakeven with a profit of ?! The break-even spot prices are c) At the expiration date, when the trader closes all positions, the stock sells for $45. What is their net profit (indicate a gain or a loss)? Profit is ; Indicate "positive" or "negative Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts