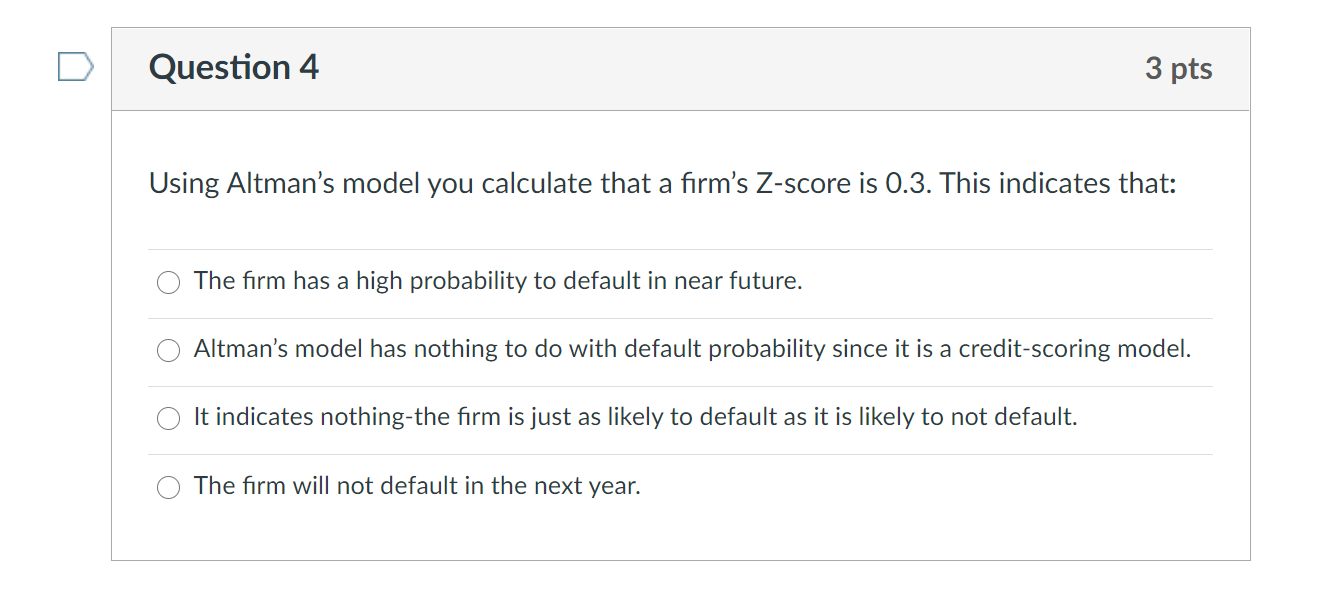

Question: Question 4 3 pts Using Altman's model you calculate that a firm's Z-score is 0.3. This indicates that: The firm has a high probability to

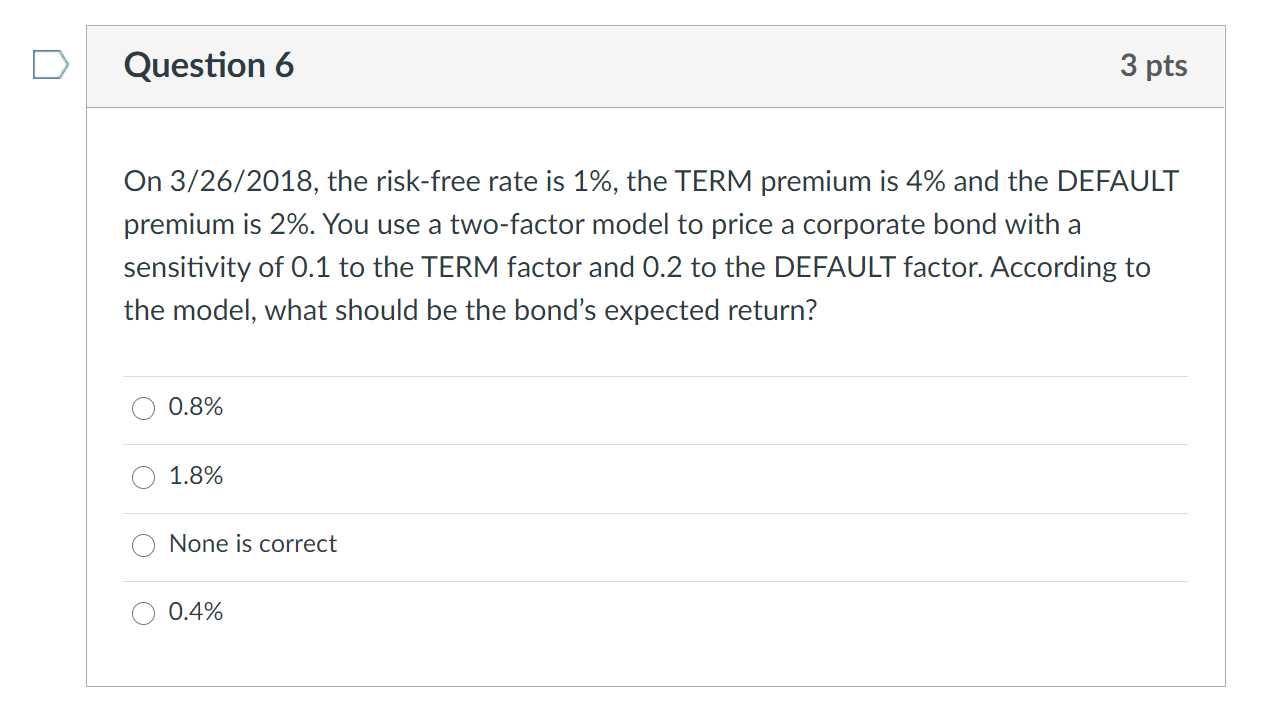

Question 4 3 pts Using Altman's model you calculate that a firm's Z-score is 0.3. This indicates that: The firm has a high probability to default in near future. Altman's model has nothing to do with default probability since it is a credit scoring model. It indicates nothing-the firm is just as likely to default as it is likely to not default. The firm will not default in the next year. Question 6 3 pts On 3/26/2018, the risk-free rate is 1%, the TERM premium is 4% and the DEFAULT premium is 2%. You use a two-factor model to price a corporate bond with a sensitivity of 0.1 to the TERM factor and 0.2 to the DEFAULT factor. According to the model, what should be the bond's expected return? 0.8% 1.8% None is correct 0.4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts