Question: QUESTION 4 [30 MARKS] Oscar plc [6 Marks] The directors of Oscar plc are considering opening a factory to manufacture a new product. Detailed

![QUESTION 4 [30 MARKS] Oscar plc [6 Marks] The directors of Oscar](https://s3.amazonaws.com/si.experts.images/answers/2024/05/664cc5e49e0c8_428664cc5e417d47.jpg)

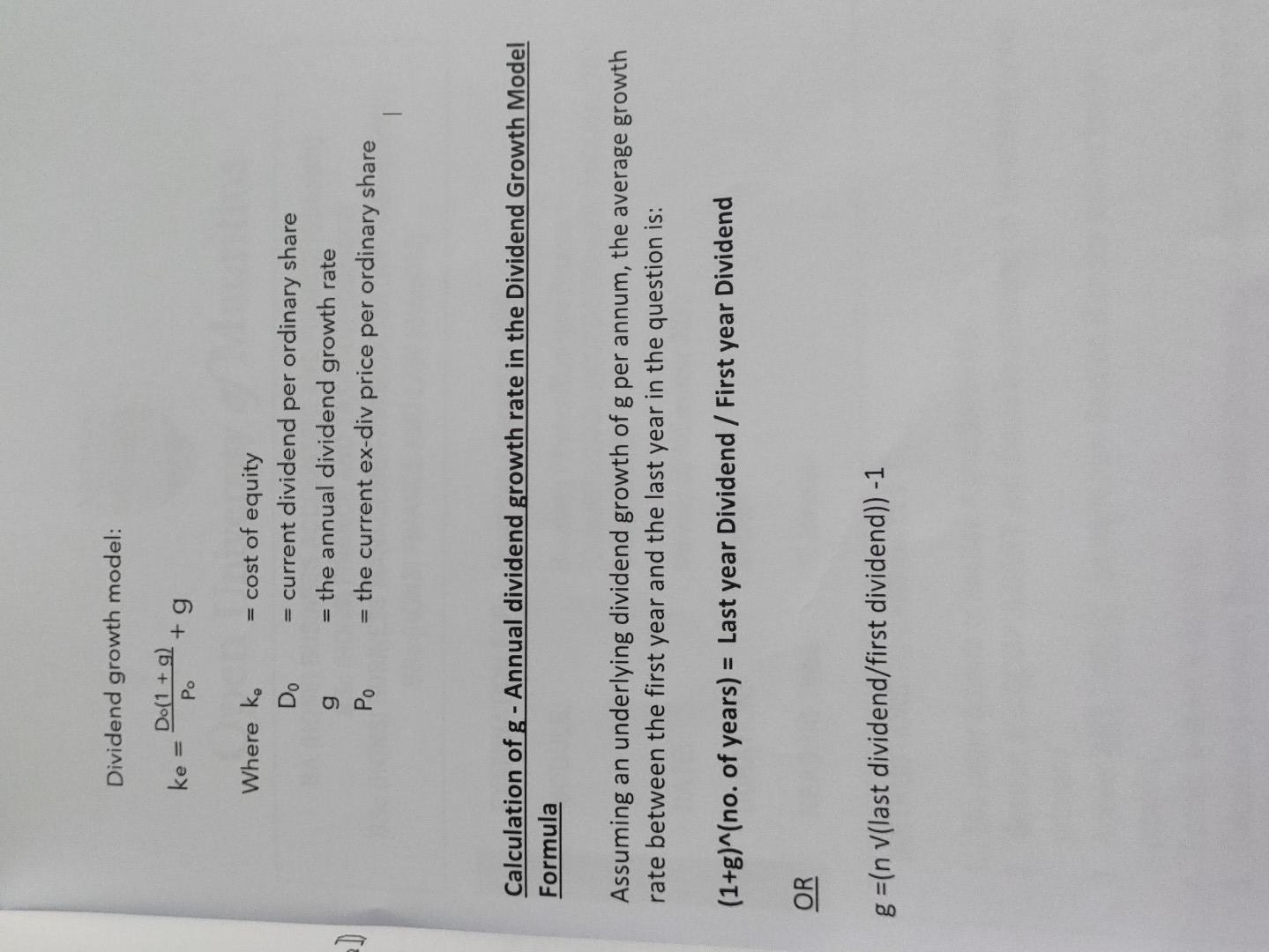

QUESTION 4 [30 MARKS] Oscar plc [6 Marks] The directors of Oscar plc are considering opening a factory to manufacture a new product. Detailed forecasts of the product's expected cash flows have been made, and it is estimated that an initial investment of 2.5 million is required. During the last 5 years the number of shares (equity) in issue has remained constant at 3 million, and the market price per share (current ex-div. price per ordinary share) at 31 December 2011 is 135p. The company pays only one dividend each year (on 31 December) and dividends for the last 5 years have been as follows. Year Dividend per share (pence) 2007 2008 2009 2010 2011 10.0 10.8 11.6 13.6 13.6 The company also has outstanding a 900,000 bank loan repayable on 31 December 2019. The rate of interest on this debt is variable, currently at 16.5%. REQUIRED (a) Calculate the weighted average cost of capital (WACC) for Oscar plc as at 31 December 2011. (For calculation of cost of equity, Ke, you may make reference to the formula sheet - page 16) [10 Marks] (b) Explain to the directors of Oscar plc what assumptions they are making if the WACC calculation in part 1 above is used to discount the expected cash flows of the project. [5 marks] equity D Dividend growth model: Do(1+g) ke =1 Po + g Where k = cost of equity Do = current dividend per ordinary share g Po = the annual dividend growth rate = the current ex-div price per ordinary share Calculation of g - Annual dividend growth rate in the Dividend Growth Model Formula Assuming an underlying dividend growth of g per annum, the average growth rate between the first year and the last year in the question is: (1+g)^(no. of years) = Last year Dividend / First year Dividend OR g=(n v(last dividend/first dividend)) -1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts