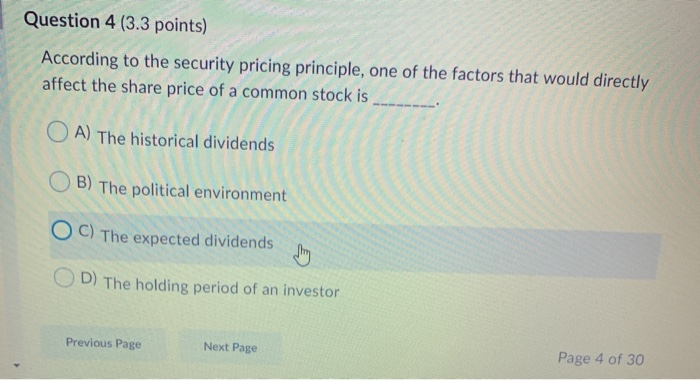

Question: Question 4 (3.3 points) According to the security pricing principle, one of the factors that would directly affect the share price of a common stock

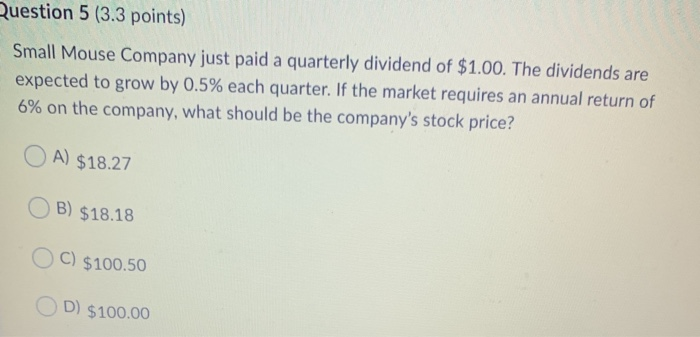

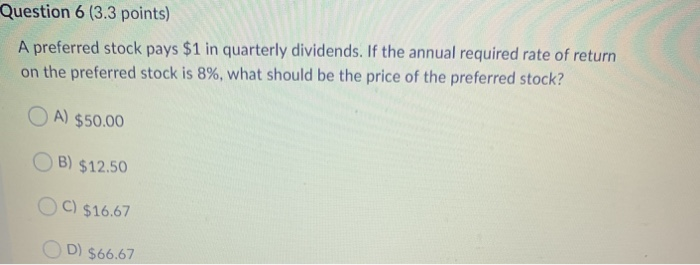

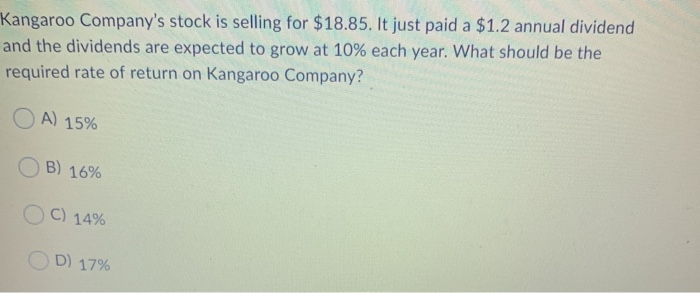

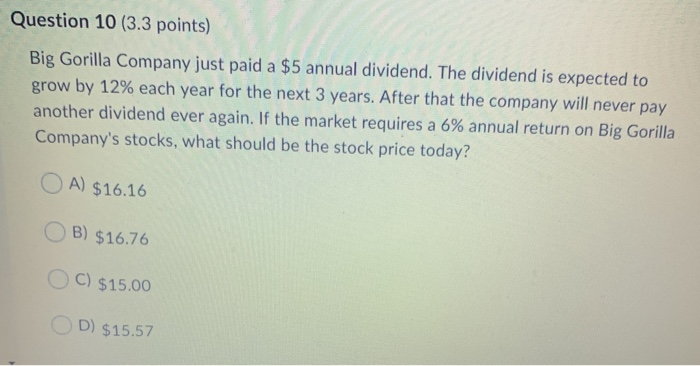

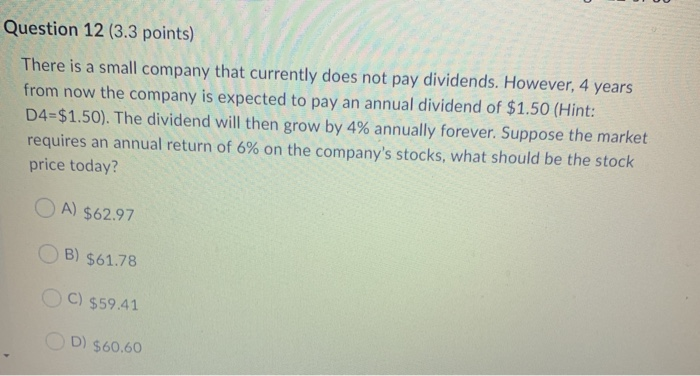

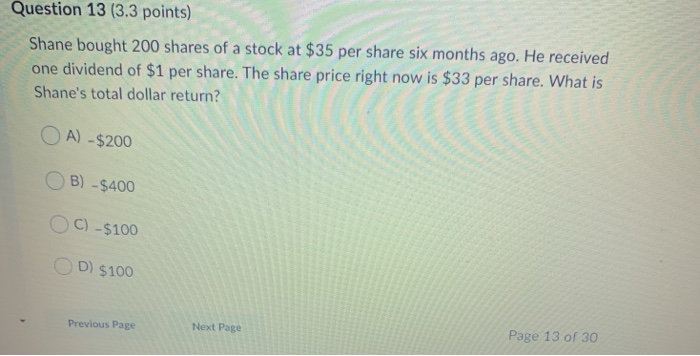

Question 4 (3.3 points) According to the security pricing principle, one of the factors that would directly affect the share price of a common stock is OA) The historical dividends OB) The political environment OC) The expected dividends OD) The holding period of an investor Previous Page Next Page Page 4 of 30 Question 5 (3.3 points) Small Mouse Company just paid a quarterly dividend of $1.00. The dividends are expected to grow by 0.5% each quarter. If the market requires an annual return of 6% on the company, what should be the company's stock price? O A) $18.27 OB) $18.18 OC) $100.50 OD) $100.00 Question 6 (3.3 points) A preferred stock pays $1 in quarterly dividends. If the annual required rate of return on the preferred stock is 8%, what should be the price of the preferred stock? OA) $50.00 OB) $12.50 OC) $16.67 OD) $66.67 Kangaroo Company's stock is selling for $18.85. It just paid a $1.2 annual dividend and the dividends are expected to grow at 10% each year. What should be the required rate of return on Kangaroo Company? OA) 15% OB) 16% OC) 14% D) 17% Question 10 (3.3 points) Big Gorilla Company just paid a $5 annual dividend. The dividend is expected to grow by 12% each year for the next 3 years. After that the company will never pay another dividend ever again. If the market requires a 6% annual return on Big Gorilla Company's stocks, what should be the stock price today? O A) $16.16 B) $16.76 OC) $15.00 OD) $15.57 Question 12 (3.3 points) There is a small company that currently does not pay dividends. However, 4 years from now the company is expected to pay an annual dividend of $1.50 (Hint: D4=$1.50). The dividend will then grow by 4% annually forever. Suppose the market requires an annual return of 6% on the company's stocks, what should be the stock price today? OA) $62.97 B) $61.78 C) $59.41 D) $60.60 Question 13 (3.3 points) Shane bought 200 shares of a stock at $35 per share six months ago. He received one dividend of $1 per share. The share price right now is $33 per share. What is Shane's total dollar return? OA) - $200 OB) - $400 C) - $100 D) $100 Previous Page Next Page Page 13 of 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts