Question: Question 4 (34 points) Titanium, Inc. is analyzing a 3-year project with the following base-case information: In Year 0: 1. The project will require the

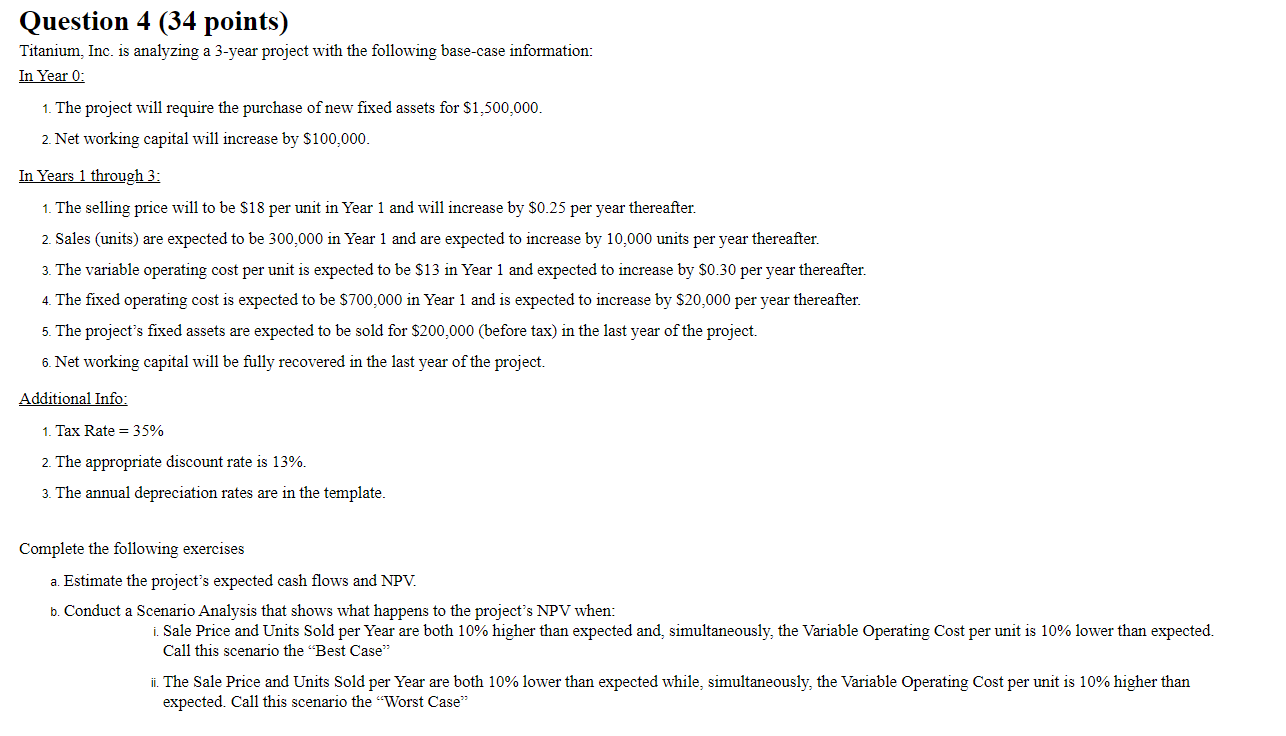

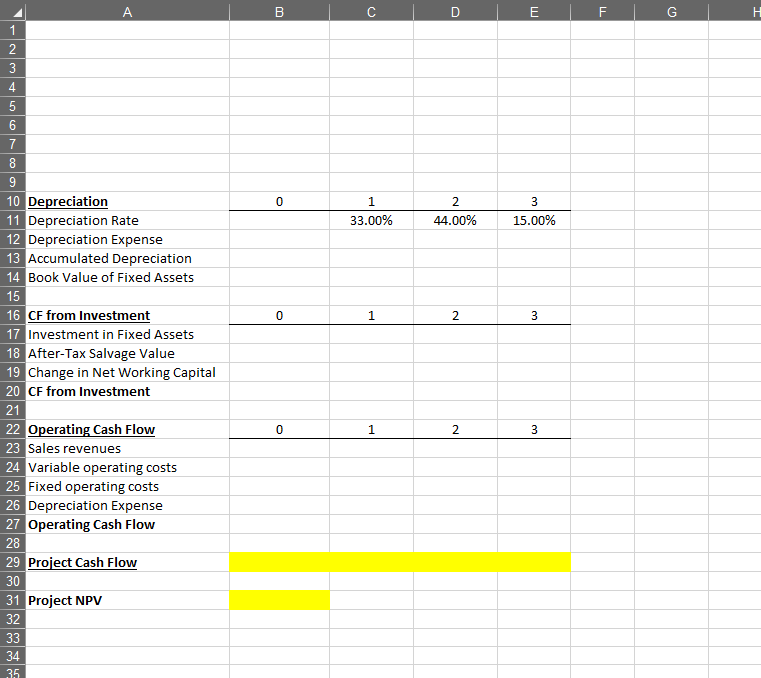

Question 4 (34 points) Titanium, Inc. is analyzing a 3-year project with the following base-case information: In Year 0: 1. The project will require the purchase of new fixed assets for $1,500,000. 2. Net working capital will increase by $100,000. In Years 1 through 3: 1. The selling price will to be $18 per unit in Year 1 and will increase by $0.25 per year thereafter. 2. Sales (units) are expected to be 300,000 in Year 1 and are expected to increase by 10,000 units per year thereafter. 3. The variable operating cost per unit is expected to be $13 in Year 1 and expected to increase by $0.30 per year thereafter. 4. The fixed operating cost is expected to be $700,000 in Year 1 and is expected to increase by $20,000 per year thereafter. 5. The project's fixed assets are expected to be sold for $200,000 (before tax) in the last year of the project. 6. Net working capital will be fully recovered in the last year of the project. Additional Info: 1. Tax Rate = 35% The appropriate discount rate is 13%. 3. The annual depreciation rates are in the template. Complete the following exercises a. Estimate the project's expected cash flows and NPV. b. Conduct a Scenario Analysis that shows what happens to the project's NPV when: 1. Sale Price and Units Sold per Year are both 10% higher than expected and, simultaneously, the Variable Operating Cost per unit is 10% lower than expected Call this scenario the "Best Case" ii. The Sale Price and Units Sold per Year are both 10% lower than expected while simultaneously, the Variable Operating Cost per unit is 10% higher than expected. Call this scenario the "Worst Case" A B C D E H 1 0 1 33.00% 2 44.00% 3 15.00% 0 1 2 3 2 3 4 5 6 7 8 9 10 Depreciation 11 Depreciation Rate 12 Depreciation Expense 13 Accumulated Depreciation 14 Book Value of Fixed Assets 15 16 CF from Investment 17 Investment in Fixed Assets 18 After-Tax Salvage Value 19 Change in Net Working Capital 20 CF from Investment 21 22 Operating Cash Flow 23 Sales revenues 24 Variable operating costs 25 Fixed operating costs 26 Depreciation Expense 27 Operating Cash Flow 28 29 Project Cash Flow 30 31 Project NPV 32 33 34 35 0 1 2 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts