Question: QUESTION 4 . 4 . 1 ) Explain the framework of total return swaps ( TRS ) . While entering a credit swap does not

QUESTION

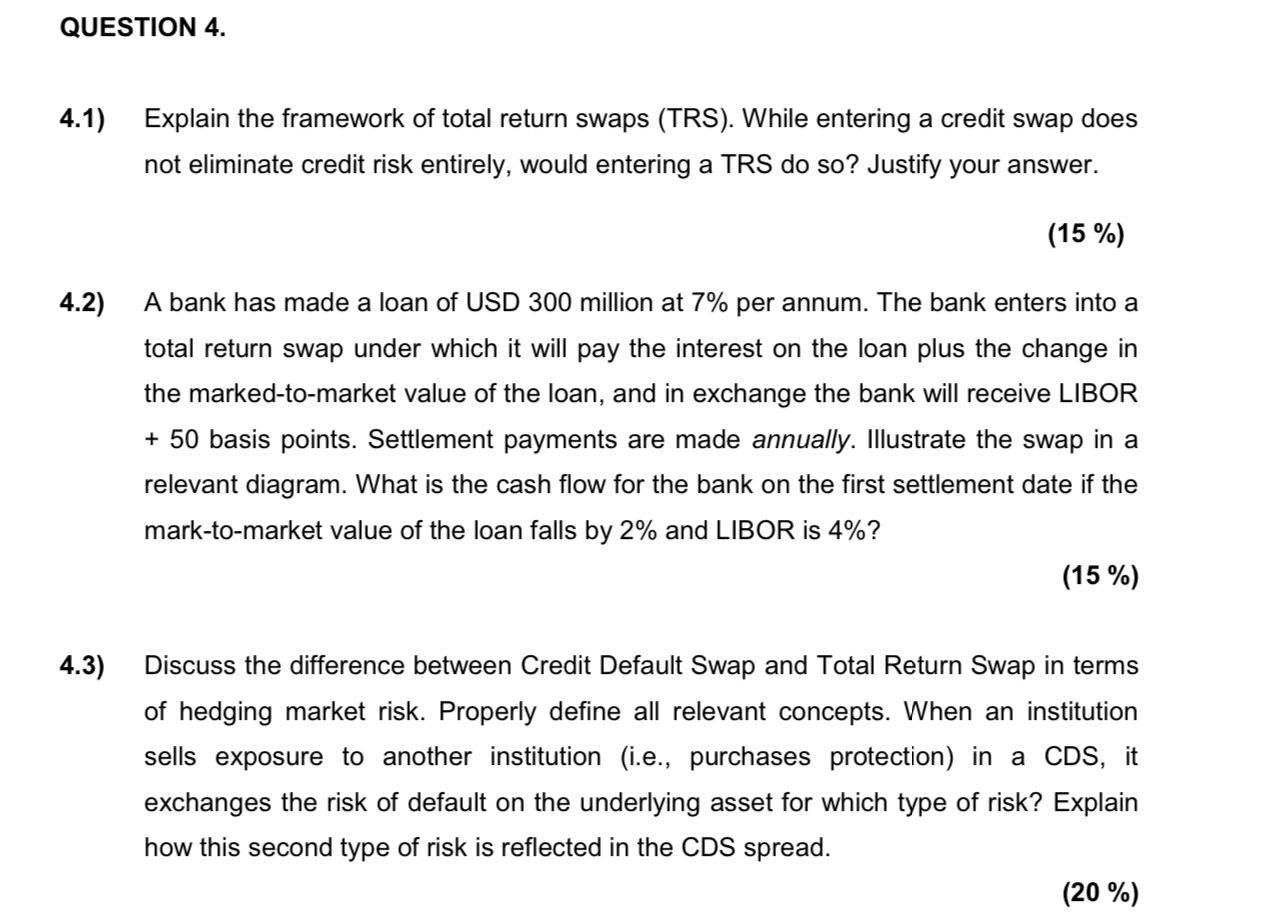

Explain the framework of total return swaps TRS While entering a credit swap does not eliminate credit risk entirely, would entering a TRS do so Justify your answer.

A bank has made a loan of USD million at per annum. The bank enters into a total return swap under which it will pay the interest on the loan plus the change in the markedtomarket value of the loan, and in exchange the bank will receive LIBOR basis points. Settlement payments are made annually. Illustrate the swap in a relevant diagram. What is the cash flow for the bank on the first settlement date if the marktomarket value of the loan falls by and LIBOR is

Discuss the difference between Credit Default Swap and Total Return Swap in terms of hedging market risk. Properly define all relevant concepts. When an institution sells exposure to another institution ie purchases protection in a CDS it exchanges the risk of default on the underlying asset for which type of risk? Explain how this second type of risk is reflected in the CDS spread.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock