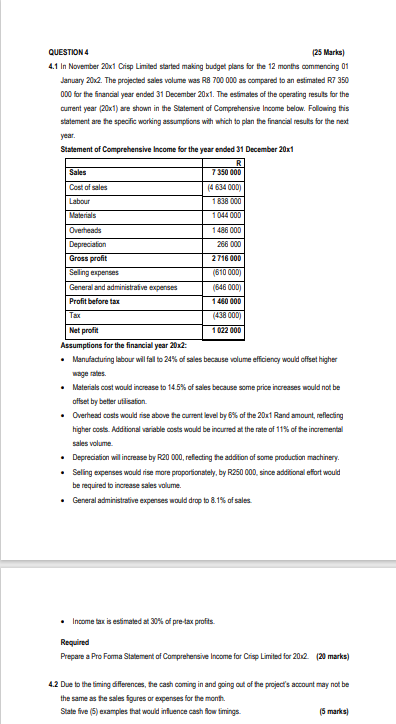

Question: QUESTION 4 4 . 1 In November 2 0 x 1 Cisp Limited started making budget plans for the 1 2 months commencing 0 1

QUESTION In November x Cisp Limited started making budget plans for the months commencing January The projected sales volume was R as compared to an estimated R for the financial year ended December x The estimates of the operating results for the current year x are shown in the Salement of Comprehensive Income below. Following this statement are the specific working assumptions with which to plan the financial results for the next year. Statement of Comprehensive Income for the year ended December x Assumptions for the financial year : Manufacturing labour will fall to of sales because volume efficiency would offset higher wage rates. Materials cost would increase to of sales because some price increases would not be offset by better utifisation. Overhead costs would fise above the current level by of the times Rand amount, reflecting higher costs. Additional variable costs would be incurred at the rate of of the incremental sales volume. Depreciation will increase by R reflecting the addition of some production machinery. Seling expenses would rise more proportionately, by R since addifional effort would be required to increase sales volume. General administrative expenses would drop to of sales. Income tax is estimated at of pretax profis. Required Prepare a Pro Forma Statement of Comprehensive Income for Cisp Limited for marks Due to the liming differences, the cash coming in and going out of the project's account may not be the same as the sales figures or expenses for the month. State five examples that would influence cash flow finings.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock