Question: QUESTION 4 4 points Save Answer Haddon Incorporated owns a delivery truck. The company purchased the truck on January 1, 2016 and put it into

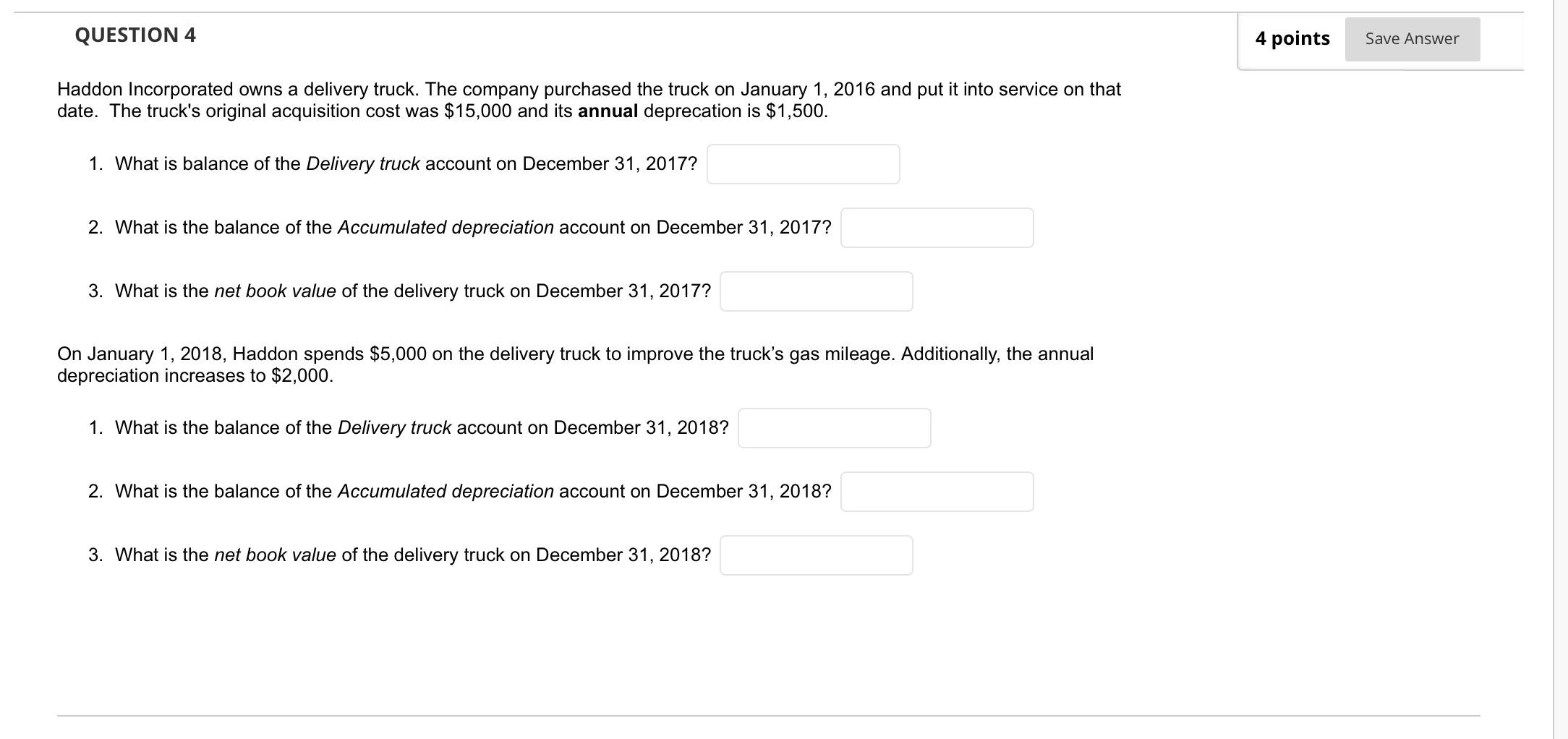

QUESTION 4 4 points Save Answer Haddon Incorporated owns a delivery truck. The company purchased the truck on January 1, 2016 and put it into service on that date. The truck's original acquisition cost was $15,000 and its annual deprecation is $1,500. 1. What is balance of the Delivery truck account on December 31, 2017? 2. What is the balance of the Accumulated depreciation account on December 31, 2017? 3. What is the net book value of the delivery truck on December 31, 2017? On January 1, 2018, Haddon spends $5,000 on the delivery truck to improve the truck's gas mileage. Additionally, the annual depreciation increases to $2,000. 1. What is the balance of the Delivery truck account on December 31, 2018? 2. What is the balance of the Accumulated depreciation account on December 31, 2018? 3. What is the net book value of the delivery truck on December 31, 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts