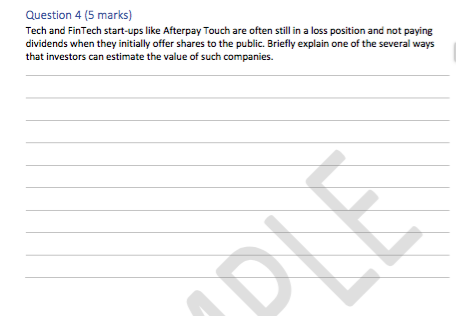

Question: Question 4 (5 marks) Tech and FinTech start-ups like Afterpay Touch are often still in a loss position and not paying dividends when they initially

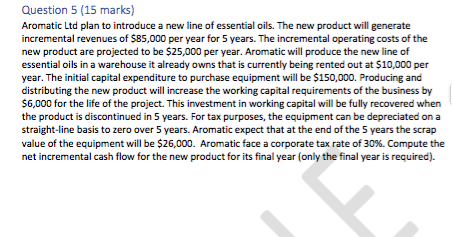

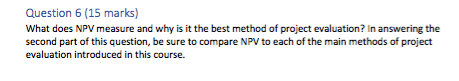

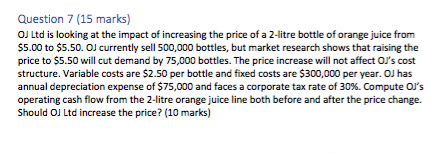

Question 4 (5 marks) Tech and FinTech start-ups like Afterpay Touch are often still in a loss position and not paying dividends when they initially offer shares to the public. Briefly explain one of the several ways that investors can estimate the value of such companies. Question 5 (15 marks) Aromatic Ltd plan to introduce a new line of essential oils. The new product will generate incremental revenues of $85,000 per year for 5 years. The incremental operating costs of the new product are projected to be $25,000 per year. Aromatic will produce the new line of essential oils in a warehouse it already owns that is currently being rented out at $10,000 per year. The initial capital expenditure to purchase equipment will be $150,000. Producing and distributing the new product will increase the working capital requirements of the business by $6,000 for the life of the project. This investment in working capital will be fully recovered when the product is discontinued in 5 years. For tax purposes, the equipment can be depreciated on a straight-line basis to zero over 5 years. Aromatic expect that at the end of the 5 years the scrap value of the equipment will be $26,000. Aromatic face a corporate tax rate of 30%. Compute the net incremental cash flow for the new product for its final year (only the final year is required). Question 6 (15 marks) What does NPV measure and why is it the best method of project evaluation? In answering the second part of this question, be sure to compare NPV to each of the main methods of project evaluation introduced in this course. Question 7 (15 marks) OJ Ltd is looking at the impact of increasing the price of a 2-litre bottle of orange juice from $5.00 to $5.50. OJ currently sell 500,000 bottles, but market research shows that raising the price to $5.50 will cut demand by 75,000 bottles. The price increase will not affect OJ's cost structure. Variable costs are $2.50 per bottle and fixed costs are $300,000 per year. OJ has annual depreciation expense of $75,000 and faces a corporate tax rate of 30%. Compute OJ's operating cash flow from the 2-litre orange juice line both before and after the price change. Should OJ Ltd increase the price? (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts