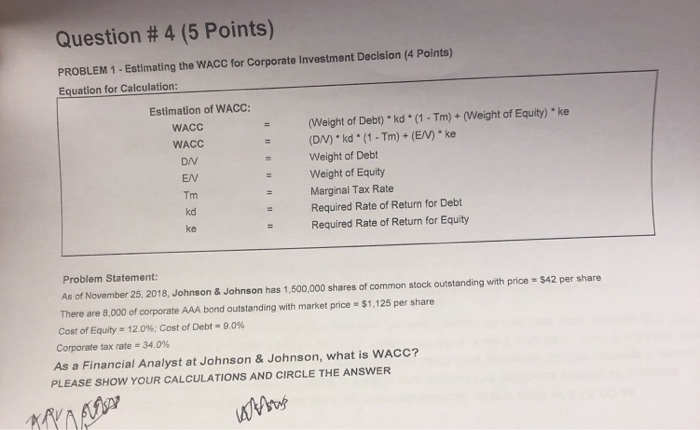

Question: Question # 4 (5 Points) PROBLEM 1- Estimating the WACC for Corporate Investment Decision (4 Points) Equation for Calculation: Estimation of WACC: WACC WACC DV

Question # 4 (5 Points) PROBLEM 1- Estimating the WACC for Corporate Investment Decision (4 Points) Equation for Calculation: Estimation of WACC: WACC WACC DV EV Tm kd ke (Weight of Debt) kd *(1 Tm) + (Weight of Equity) ke (DM) . kd * (1 . Tin) + (EN) . ke Weight of Debt Weight of Equity Marginal Tax Rate Required Rate of Return for Debt Required Rate of Return for Equity Problem Statement: As of November 25, 2018, Johnson & Johnson has 1,500,000 shares of common stock outstanding with price There are 8,000 of corporate AAA bond outstanding with market price = $1,125 per share Cost of Equity 12.0%; Cost of Debt " 9.0% $42 per share Corporate tax rate = 34.0% As a Financial Analyst at Johnson& Johnson, what is WACC? PLEASE SHOW YOUR CALCULATIONS AND CIRCLE THE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts