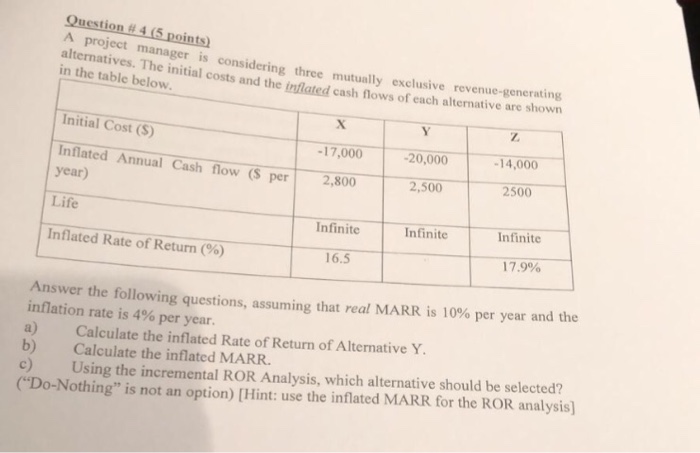

Question: Question #4 (5 points) project manager alternatives. The in the table below. is considering three mutually exclusive revenue-generating itial costs and the inflated cash flows

Question #4 (5 points) project manager alternatives. The in the table below. is considering three mutually exclusive revenue-generating itial costs and the inflated cash flows of each alternative are shown Initial Cost (S) -17,000 -20,000 -14,000 Inflated Annual Cash flow (s per 2,800 2,500 2500 year) Life Infinite Infinite Infinit Inflated Rate of Return (%) 16.5 7.9% Answer the following questions, assuming that real MARR is 10% per year and the inflation rate is 4% per year. a) Calculate the inflated Rate of Return of Alternative Y. b) Calculate the inflated MARR. c) Using the incremental ROR Analysis, which alternative should be selected? ("Do-Nothing" is not an option) [Hint: use the inflated MARR for the ROR analysis)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts