Question: Question 4 ( 6 . 5 points ) To compute the implied equity risk premium ( ERP ) , one input that you need is

Question points

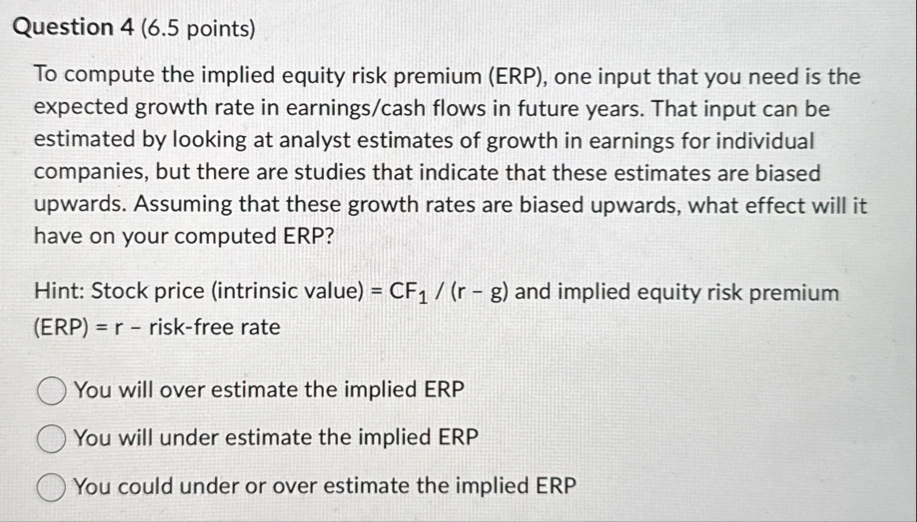

To compute the implied equity risk premium ERP one input that you need is the expected growth rate in earningscash flows in future years. That input can be estimated by looking at analyst estimates of growth in earnings for individual companies, but there are studies that indicate that these estimates are biased upwards. Assuming that these growth rates are biased upwards, what effect will it have on your computed ERP?

Hint: Stock price intrinsic value and implied equity risk premium risk free rate

You will over estimate the implied ERP

You will under estimate the implied ERP

You could under or over estimate the implied ERP

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock