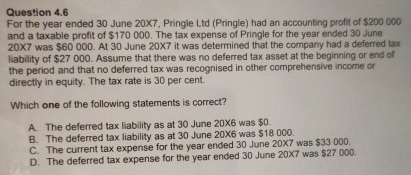

Question: Question 4 . 6 For the year ended 3 0 June 2 0 X 7 . Pringle Ltd ( Pringle ) had an accounting profit

Question

For the year ended June X Pringle Ltd Pringle had an accounting profit of $ and a taxable profit of $ The tax expense of Pringle for the year ended June was $ At June it was determined that the company had a deferred tax liability of $ Assume that there was no deferred tax asset at the beginning or end of the period and that no deferred tax was recognised in other comprehensive income or directly in equity. The tax rate is per cent.

Which one of the following statements is correct?

A The deferred tax liability as at June was $

B The deferred tax liability as at June was $

C The current tax expense for the year ended June was $

D The deferred tax expense for the year ended June was $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock