Question: Question 4 ( 6 points ) : Currency Carry Trade ( Chapter 6 ) Suppose you conduct currency carry trade by borrowing $ 1 million

Question points: Currency Carry Trade Chapter

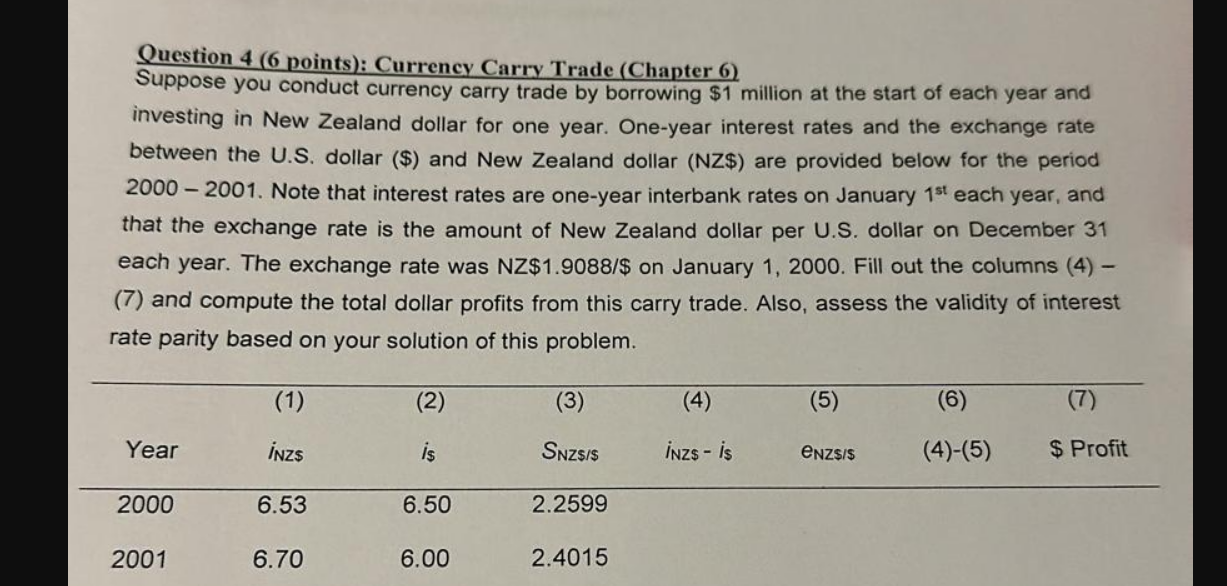

Suppose you conduct currency carry trade by borrowing $ million at the start of each year and

investing in New Zealand dollar for one year. Oneyear interest rates and the exchange rate

between the US dollar $ and New Zealand dollar NZ$ are provided below for the period

Note that interest rates are oneyear interbank rates on January each year, and

that the exchange rate is the amount of New Zealand dollar per US dollar on December

each year. The exchange rate was NZ $ on January Fill out the columns

and compute the total dollar profits from this carry trade. Also, assess the validity of interest

rate parity based on your solution of this problem.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock