Question: Question 4 (6 points) Laptech Inc. is a local supplier of Microchip Crystals is considering expanding globally which will lead to increased credit sales. While

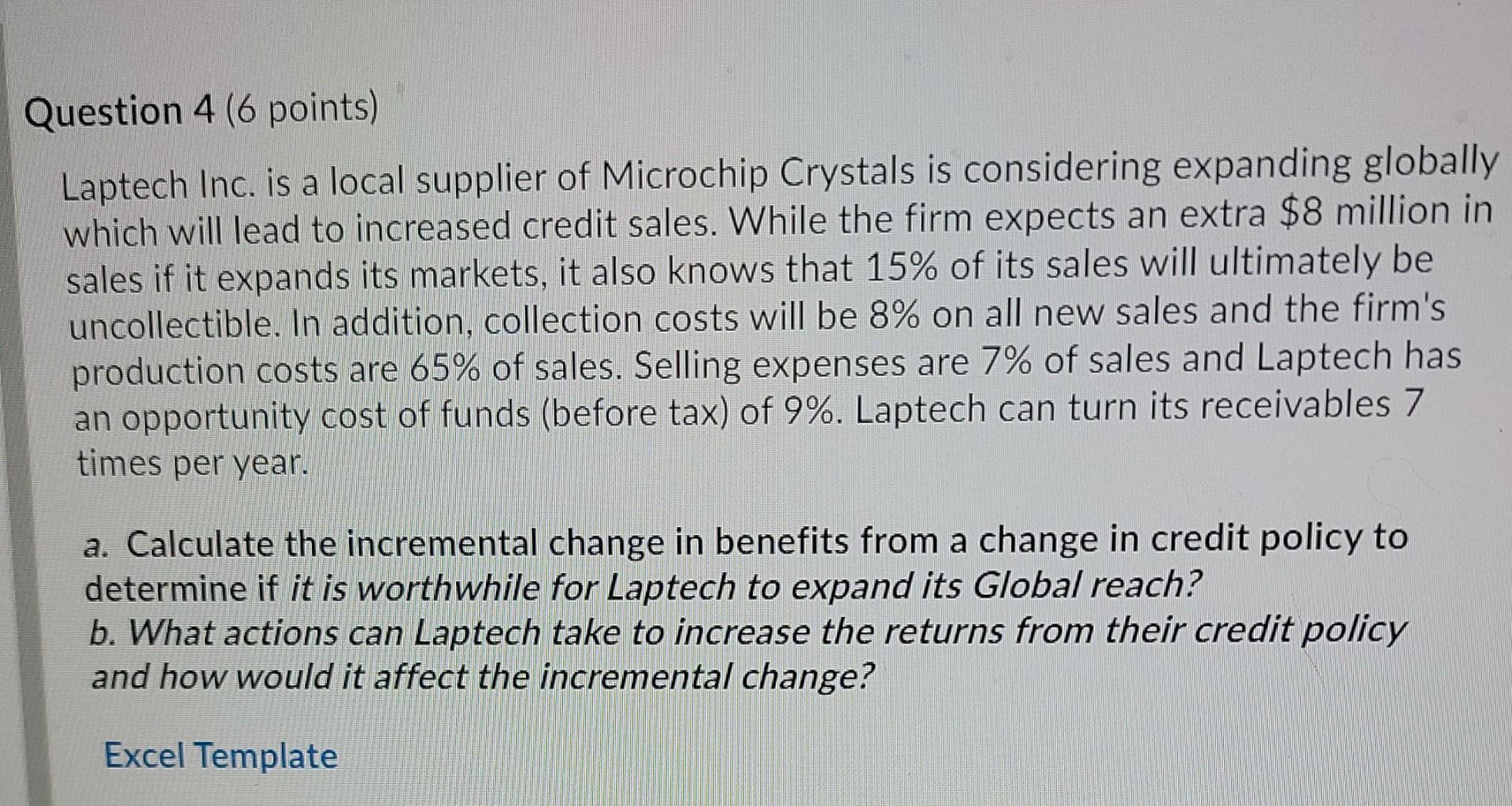

Question 4 (6 points) Laptech Inc. is a local supplier of Microchip Crystals is considering expanding globally which will lead to increased credit sales. While the firm expects an extra $8 million in sales if it expands its markets, it also knows that 15% of its sales will ultimately be uncollectible. In addition, collection costs will be 8% on all new sales and the firm's production costs are 65% of sales. Selling expenses are 7% of sales and Laptech has an opportunity cost of funds (before tax) of 9%. Laptech can turn its receivables 7 times per year. a. Calculate the incremental change in benefits from a change in credit policy to determine if it is worthwhile for Laptech to expand its Global reach? b. What actions can Laptech take to increase the returns from their credit policy and how would it affect the incremental change? Excel Template Question 4 (6 points) Laptech Inc. is a local supplier of Microchip Crystals is considering expanding globally which will lead to increased credit sales. While the firm expects an extra $8 million in sales if it expands its markets, it also knows that 15% of its sales will ultimately be uncollectible. In addition, collection costs will be 8% on all new sales and the firm's production costs are 65% of sales. Selling expenses are 7% of sales and Laptech has an opportunity cost of funds (before tax) of 9%. Laptech can turn its receivables 7 times per year. a. Calculate the incremental change in benefits from a change in credit policy to determine if it is worthwhile for Laptech to expand its Global reach? b. What actions can Laptech take to increase the returns from their credit policy and how would it affect the incremental change? Excel Template

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts