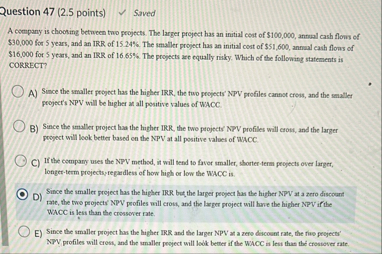

Question: Question 4 7 ( 2 . 5 points ) Saved A company is choosing between two projects. The larger project has an initial cost of

Question points

Saved

A company is choosing between two projects. The larger project has an initial cost of $ annual cash flows of $ for years, and an IRR of The smaller project has an initial cost of $ annual cash flows of $ for years, and an IRR of The projects are equally risky. Which of the following statements is CORRECT?

A Sunce the smaller project has the higher IRR, the two projects' NPV profiles cannot cross, and the smaller project's NPV will be higher at all positive values of WACC.

B Since the smaller project has the higher IRR, the two projects NPV profiles will cross, and the larger project will look better based on the NPV at all positive values of WACC.

C If the company uses the NPV method, it will tend to favor smaller, shorterterm peojects over larger, longerterm projects, regardless of how high or low the WACC is

D Since the smaller project has the higher IRR but the larger peoject has the higher NPV at a are discourt rate, the two projects NPV profiles will cross, and the larger project will have the higher NPV if the WACC is less than the crossover rate.

E Since the smaller project has the higher IRR and the larger NPV at a zero discosst rate, the fire projects' NPV profiles will cross, and the smaller peoject will lobk better if the WACC is less thas the crossover rate.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock