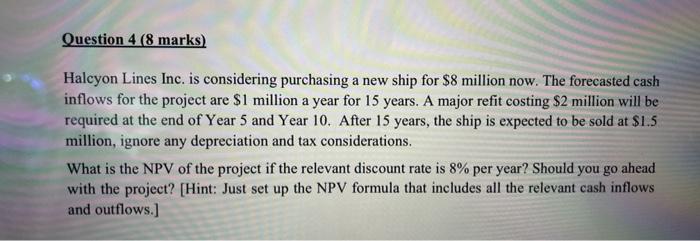

Question: Question 4 (8 marks) Halcyon Lines Inc. is considering purchasing a new ship for $8 million now. The forecasted cash inflows for the project are

Halcyon Lines Inc. is considering purchasing a new ship for $8 million now. The forecasted cash inflows for the project are $1 million a year for 15 years. A major refit costing $2 million will be required at the end of Year 5 and Year 10. After 15 years, the ship is expected to be sold at $1.5 million, ignore any depreciation and tax considerations. What is the NPV of the project if the relevant discount rate is 8% per year? Should you go ahead with the project? [Hint: Just set up the NPV formula that includes all the relevant cash inflows and outflows.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts