Question: Question 4 (9 marks) Using the information provided below for JB Hi Fi and Harvey Norman: a) Review each ratio briefly stating what it tells

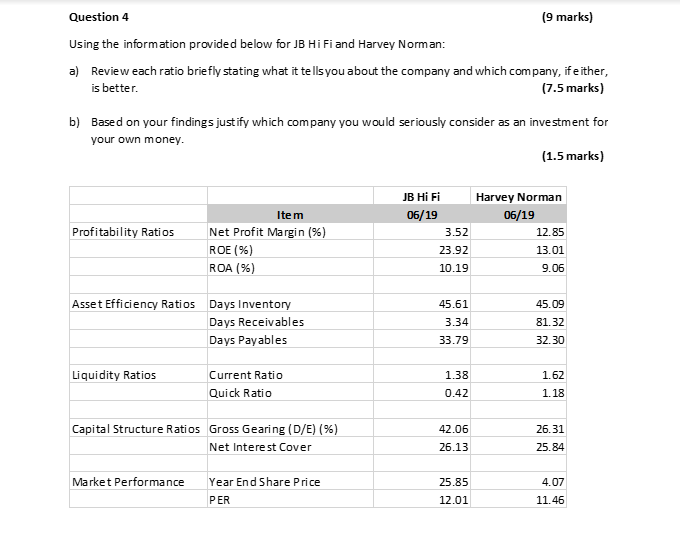

Question 4 (9 marks) Using the information provided below for JB Hi Fi and Harvey Norman: a) Review each ratio briefly stating what it tells you about the company and which company, if either, is better. (7.5 marks) b) Based on your findings justify which company you would seriously consider as an investment for your own money. (1.5 marks) Profitability Ratios Item Net Profit Margin (%) ROE (%) ROA (%) JB HiFi 06/19 3.52 23.92 10.19 Harvey Norman 06/19 12.85 13.01 9.06 45.61 Asset Efficiency Ratios Days Inventory Days Receivables Days Payables 3.34 33.79 45.09 81.32 32. 30 Liquidity Ratios Current Ratio Quick Ratio 1.38 0.42 1.62 1.18 Capital Structure Ratios Gross Gearing (D/E) (%) Net Interest Cover 42.06 26.13 26.31 25.84 Market Performance 25.85 4.07 Year End Share Price PER 12.01 11.46

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts