Question: Question 4 (a) 0'] Table Q4(a) shows the nancial information related to Cyber Aircraft Industries Ltd 'or the year ended 31 December 2016. Activity S

![Question 4 (a) 0'] Table Q4(a) shows the nancial information related](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/11/673bb9341057f_283673bb933c5698.jpg)

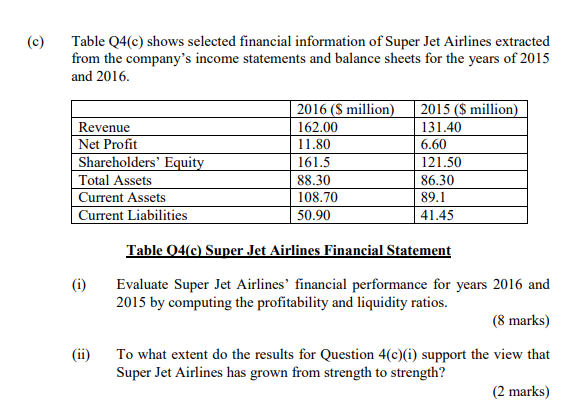

Question 4 (a) 0'] Table Q4(a) shows the nancial information related to Cyber Aircraft Industries Ltd 'or the year ended 31 December 2016. Activity S (in millions) Cash at 1 January 2016 12.85 Operating_profit 16.78 Proceeds from the sale of three tow trucks 3.20 Proceeds from long term borrowing 12.80 Proceeds from leasing out spare workshop area 2.80 Company tax Hid 9.80 Increase in accounts payable 6.68 Decrease in accounts receivable 3.65 Purchase of 100,000 shares in Eagle Airlines 26.80 Issuance of 180,000 new shares 22.00 Dividends paid out to share holders 12.80 Repayment of short term loans 2.90 Table :1 her Aircraft Industries Ltd nancial information for 2016 Demonstrate your knowledge in accounting by preparing a statement of cash flows using the indirect method. Detach the working sheet in Appendix A to answer Question 4(a) and attach to the answer book. (1 1 marks) Explain. the term, \"working capital". If a company has current assets of $10 million, a current ratio equal to 1.25 and a quick ratio equal to 1.1, calculate the company's working capital. (4 marks] (C) Table Q4{c) shows selected nancial information of Super Jet Airlines extracted from the company's income statements and balance sheets for the years of 2015 and 2016. 2016 ($ million) 2015 ($ million) Revenue 162.00 131.40 Net Prot 11.80 6.60 Shareholders' Equity 161.5 121.50 Total Assets 88.30 86.30 Current Assets 108.?0 89.1 Current Liabilities 50.90 41.45 Table 9 Su er Jet Airlines Financial Statement (i) Evaluate Super Jet Airlines' nancial performance for years 2016 and 2015 by computing the protability and liquidity ratios. (8 marks) (ii) To what extent do the results for Question 4(c](i) support the view that Super Jet Airlines has grown from strength to strength? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts