Question: Question 4 - (a), (b) and (c) Each following issue should be dealt with separately. Ignore the effects of income tax arising from these transactions

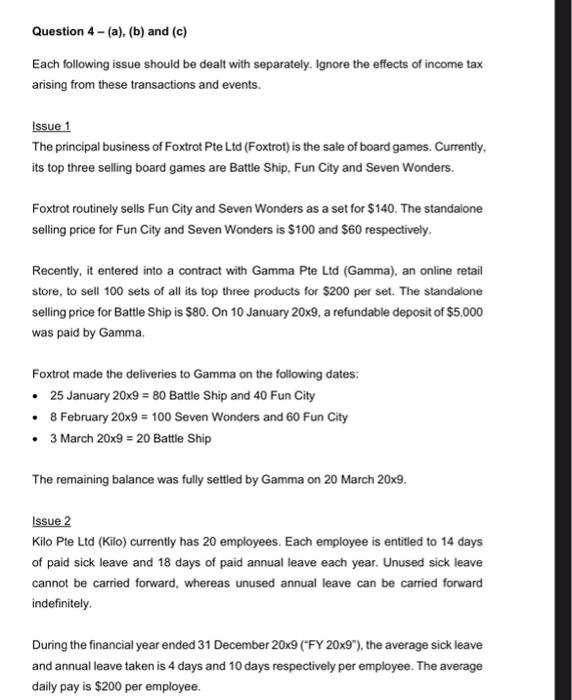

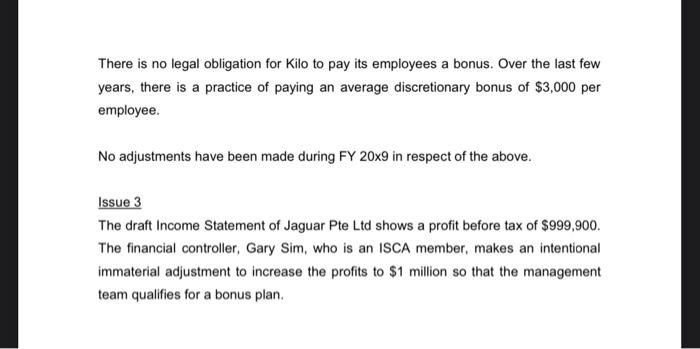

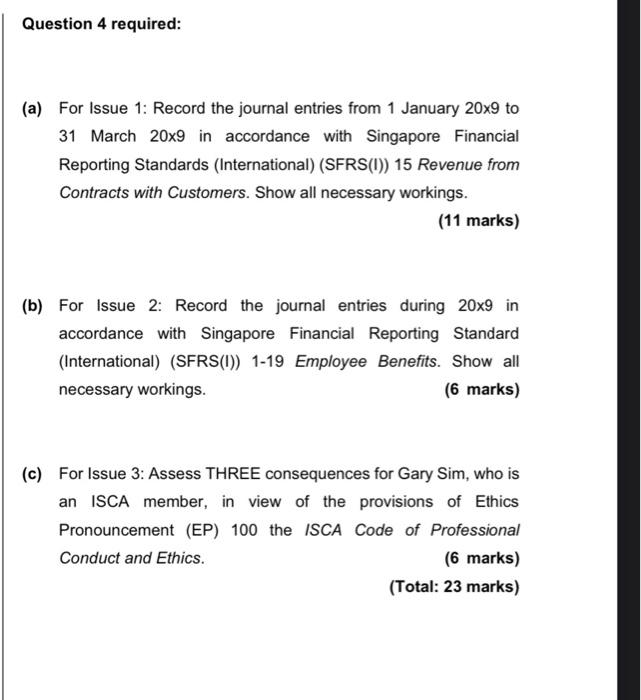

Question 4 - (a), (b) and (c) Each following issue should be dealt with separately. Ignore the effects of income tax arising from these transactions and events. Issue 1 The principal business of Foxtrot Pte Ltd (Foxtrot) is the sale of board games. Currently. its top three selling board games are Battle Ship, Fun City and Seven Wonders. Foxtrot routinely sells Fun City and Seven Wonders as a set for \\( \\$ 140 \\). The standaione selling price for Fun City and Seven Wonders is \\( \\$ 100 \\) and \\( \\$ 60 \\) respectively. Recently, it entered into a contract with Gamma Pte Ltd (Gamma), an online retail store, to sell 100 sets of all its top three products for \\( \\$ 200 \\) per set. The standalone selling price for Battle Ship is \\( \\$ 80 \\). On 10 January \\( 20 \\times 9 \\), a refundable deposit of \\( \\$ 5,000 \\) was paid by Gamma. Foxtrot made the deliveries to Gamma on the following dates: - 25 January \\( 20 \\times 9=80 \\) Battle Ship and 40 Fun City - 8 February \\( 20 \\times 9=100 \\) Seven Wonders and 60 Fun City - 3 March \\( 20 \\times 9=20 \\) Battle Ship The remaining balance was fully settled by Gamma on 20 March \\( 20 \\times 9 \\). Issue 2 Kilo Pte Ltd (Kilo) currently has 20 employees. Each employee is entitled to 14 days of paid sick leave and 18 days of paid annual leave each year. Unused sick leave cannot be carried forward, whereas unused annual leave can be carried forward indefinitely. During the financial year ended 31 December \\( 20 \\times 9 \\) (\"FY \\( 20 \\times 9 \\) ), the average sick leave and annual leave taken is 4 days and 10 days respectively per employee. The average daily pay is \\( \\$ 200 \\) per employee. There is no legal obligation for Kilo to pay its employees a bonus. Over the last few years, there is a practice of paying an average discretionary bonus of \\( \\$ 3,000 \\) per employee. No adjustments have been made during FY 20x9 in respect of the above. Issue 3 The draft Income Statement of Jaguar Pte Ltd shows a profit before tax of \\$999,900. The financial controller, Gary Sim, who is an ISCA member, makes an intentional immaterial adjustment to increase the profits to \\( \\$ 1 \\) million so that the management team qualifies for a bonus plan. (a) For Issue 1: Record the journal entries from 1 January \\( 20 \\times 9 \\) to 31 March 20x9 in accordance with Singapore Financial Reporting Standards (International) (SFRS(I)) 15 Revenue from Contracts with Customers. Show all necessary workings. (11 marks) (b) For Issue 2: Record the journal entries during 20x9 in accordance with Singapore Financial Reporting Standard (International) (SFRS(I)) 1-19 Employee Benefits. Show all necessary workings. (6 marks) (c) For Issue 3: Assess THREE consequences for Gary Sim, who is an ISCA member, in view of the provisions of Ethics Pronouncement (EP) 100 the ISCA Code of Professional Conduct and Ethics. (6 marks) (Total: 23 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts