Question: Question 4 a) b) c) d) Given below (TableQ4a) are some financial ratios for a light engineering company for years 2021 and 2020. Explain

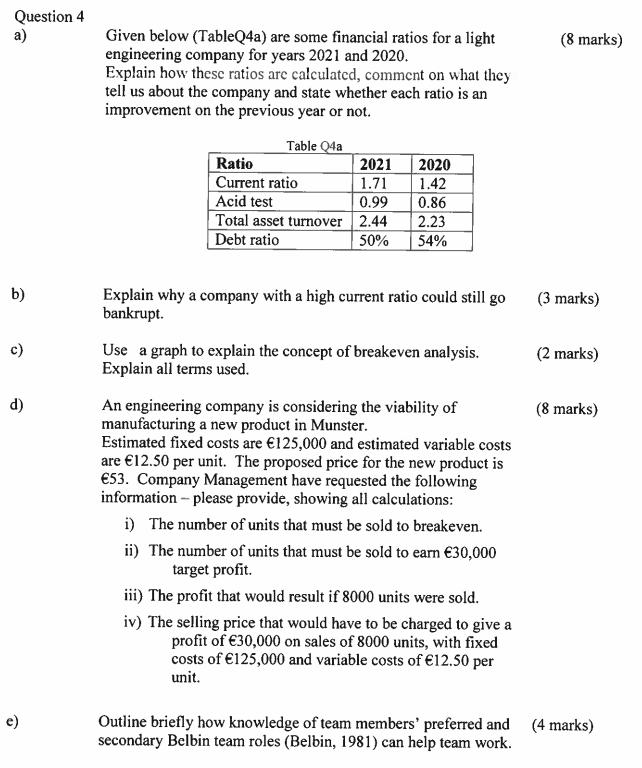

Question 4 a) b) c) d) Given below (TableQ4a) are some financial ratios for a light engineering company for years 2021 and 2020. Explain how these ratios are calculated, comment on what they tell us about the company and state whether each ratio is an improvement on the previous year or not. Table Q4a Ratio Current ratio Acid test Total asset turnover Debt ratio 2021 1.71 0.99 2.44 50% 2020 1.42 0.86 2.23 54% Explain why a company with a high current ratio could still go bankrupt. Use a graph to explain the concept of breakeven analysis. Explain all terms used. An engineering company is considering the viability of manufacturing a new product in Munster. Estimated fixed costs are 125,000 and estimated variable costs are 12.50 per unit. The proposed price for the new product is 53. Company Management have requested the following information - please provide, showing all calculations: i) The number of units that must be sold to breakeven. ii) The number of units that must be sold to earn 30,000 target profit. iii) The profit that would result if 8000 units were sold. iv) The selling price that would have to be charged to give a profit of 30,000 on sales of 8000 units, with fixed costs of 125,000 and variable costs of 12.50 per unit. (8 marks) (3 marks) (2 marks) (8 marks) Outline briefly how knowledge of team members' preferred and (4 marks) secondary Belbin team roles (Belbin, 1981) can help team work.

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

1 FINANCIAL RATIOS A Financial ratios are created with the use of numerical values taken from financial statements to acquire significant data about an organization The numbers found on an organizatio... View full answer

Get step-by-step solutions from verified subject matter experts