Question: QUESTION 4 A basic model for Stock Valuation Read Section 9-4 The Dividend Discount model (Chapter link) Watch the Concept Clip in Chapter 9 called

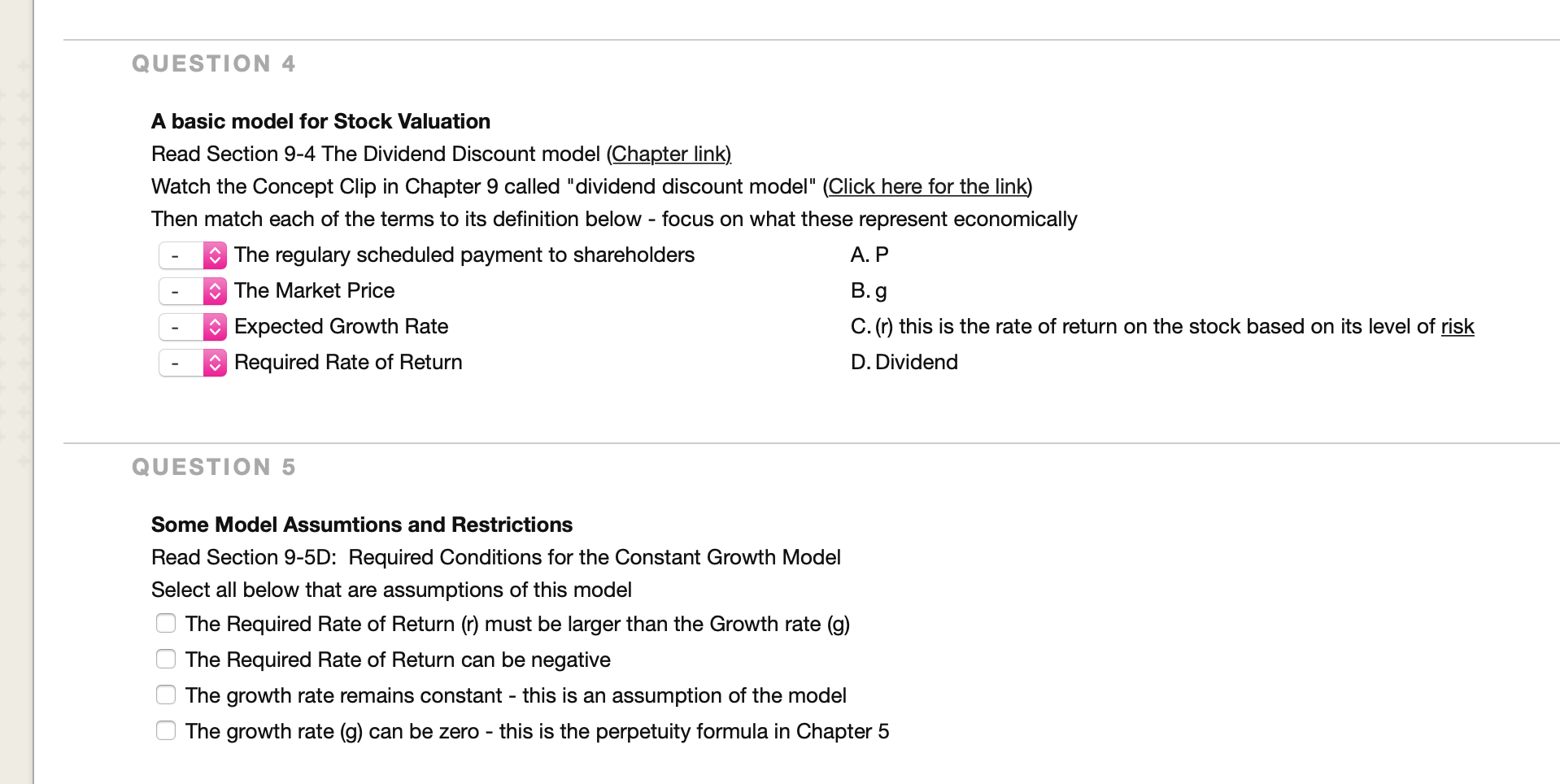

QUESTION 4 A basic model for Stock Valuation Read Section 9-4 The Dividend Discount model (Chapter link) Watch the Concept Clip in Chapter 9 called "dividend discount model" (Click here for the link) Then match each of the terms to its definition below - focus on what these represent economically The regulary scheduled payment to shareholders A.P. The Market Price B.g Expected Growth Rate C.(r) this is the rate of return on the stock based on its level of risk Required Rate of Return D. Dividend QUESTION 5 Some Model Assumtions and Restrictions Read Section 9-5D: Required Conditions for the Constant Growth Model Select all below that are assumptions of this model The Required Rate of Return (r) must be larger than the Growth rate (g) The Required Rate of Return can be negative The growth rate remains constant - this is an assumption of the model The growth rate (g) can be zero - this is the perpetuity formula in Chapter 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts