Question: QUESTION 4 A bond that pays interest annually yields a 6.65 percent rate of return. The inflation rate for the same period is 3.16 percent.

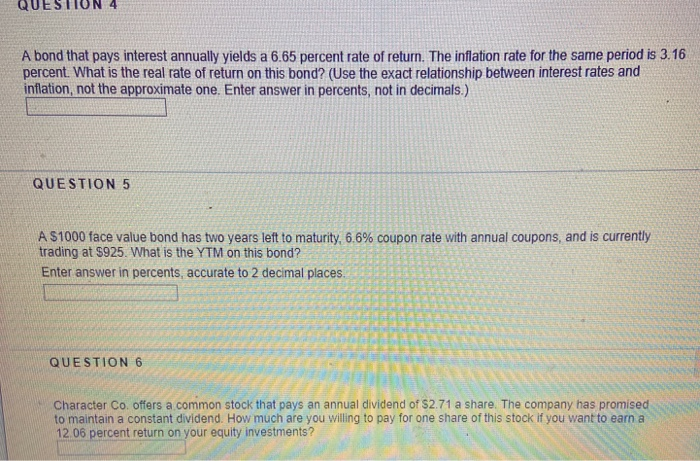

QUESTION 4 A bond that pays interest annually yields a 6.65 percent rate of return. The inflation rate for the same period is 3.16 percent. What is the real rate of return on this bond? (Use the exact relationship between interest rates and inflation, not the approximate one. Enter answer in percents, not in decimals.) QUESTION 5 8 A $1000 face value bond has two years left to maturity, 6.6% coupon rate with annual coupons, and is currently trading at $925. What is the YTM on this bond? Enter answer in percents, accurate to 2 decimal places QUESTION 6 Character Co. offers a common stock that pays an annual dividend of $2.71 a share. The company has promised to maintain a constant dividend. How much are you willing to pay for one share of this stock if you want to earn a 12.06 percent return on your equity investments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts