Question: Question 4 a How much would you be willing to pay to purchase 1 share in a company that will pay you a one-time cash

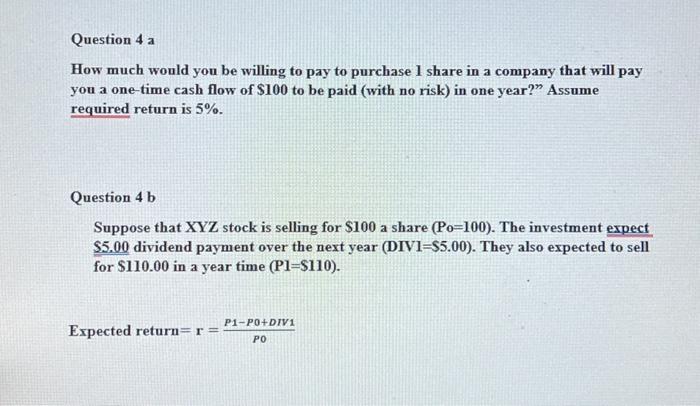

Question 4 a How much would you be willing to pay to purchase 1 share in a company that will pay you a one-time cash flow of $100 to be paid (with no risk) in one year?" Assume required return is 5%. Question 4 b Suppose that XYZ stock is selling for $100 a share (Po=100). The investment expect $5.00 dividend payment over the next year (DIVI=$5.00). They also expected to sell for $110.00 in a year time (P1=$110). Expected return =r=P0P1P0+DFV1

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock