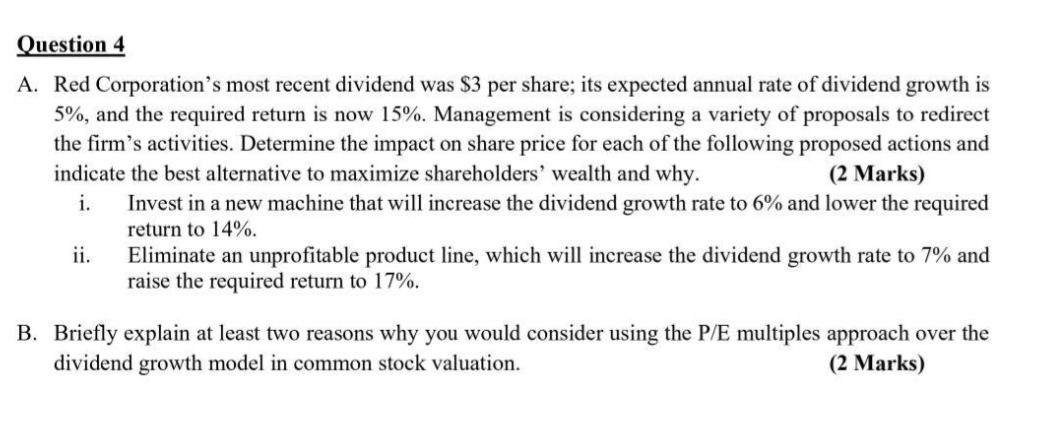

Question: Question 4 A . Red Corporation's most recent dividend was $ 3 per share; its expected annual rate of dividend growth is 5 % ,

Question

A Red Corporation's most recent dividend was $ per share; its expected annual rate of dividend growth is

and the required return is now Management is considering a variety of proposals to redirect

the firm's activities. Determine the impact on share price for each of the following proposed actions and

indicate the best alternative to maximize shareholders' wealth and why.

Marks

i Invest in a new machine that will increase the dividend growth rate to and lower the required

return to

ii Eliminate an unprofitable product line, which will increase the dividend growth rate to and

raise the required return to

B Briefly explain at least two reasons why you would consider using the multiples approach over the

dividend growth model in common stock valuation.

Marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock