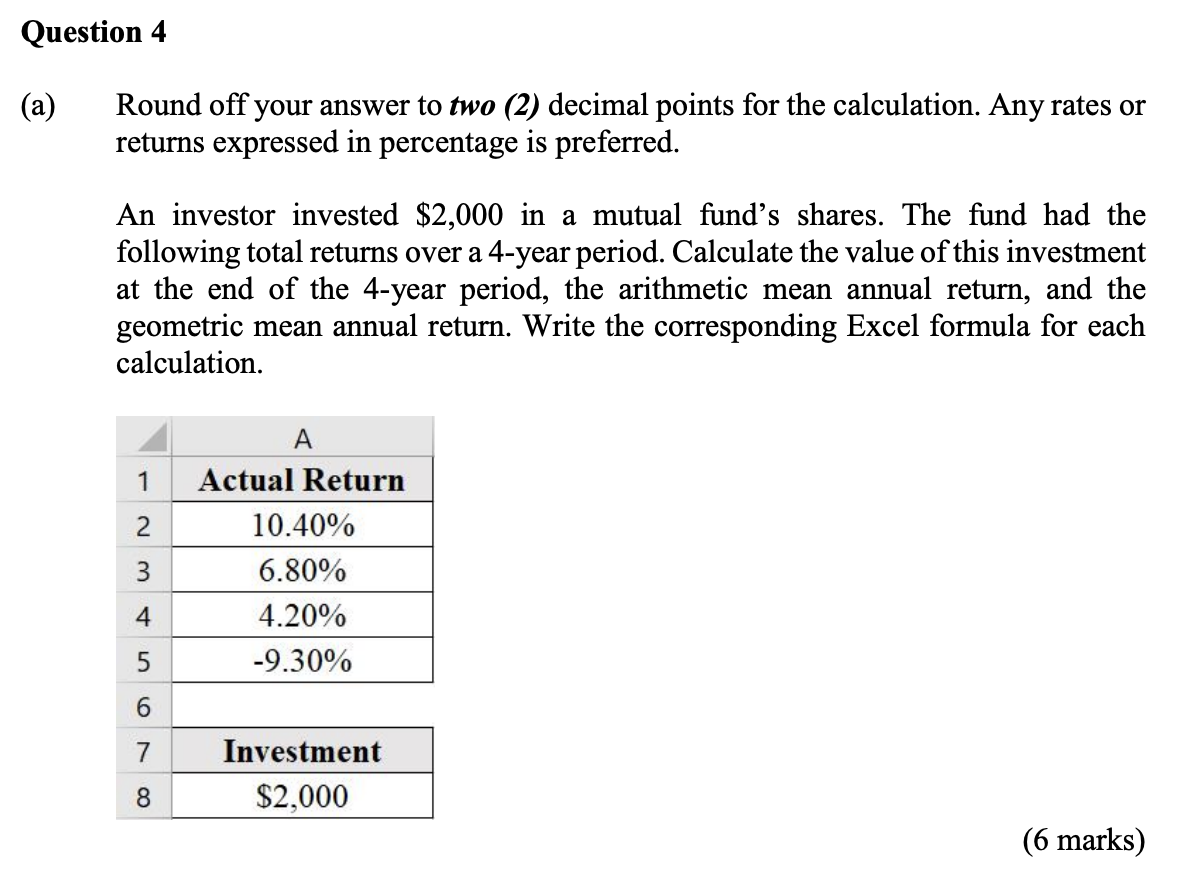

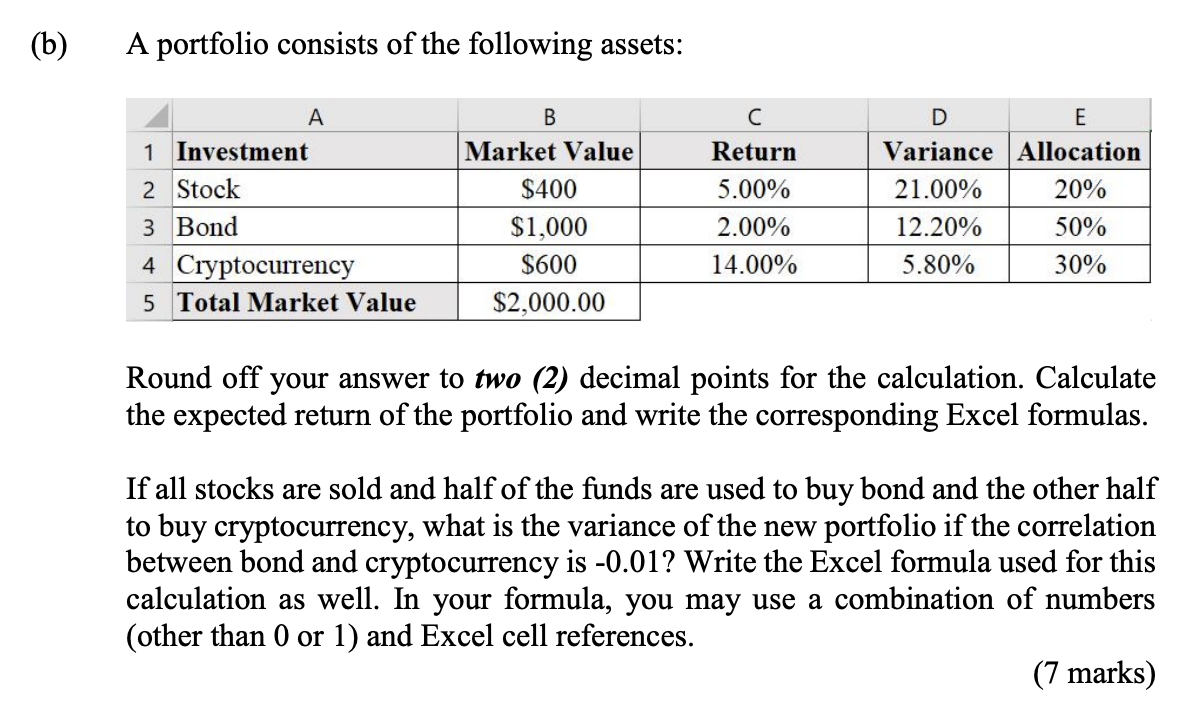

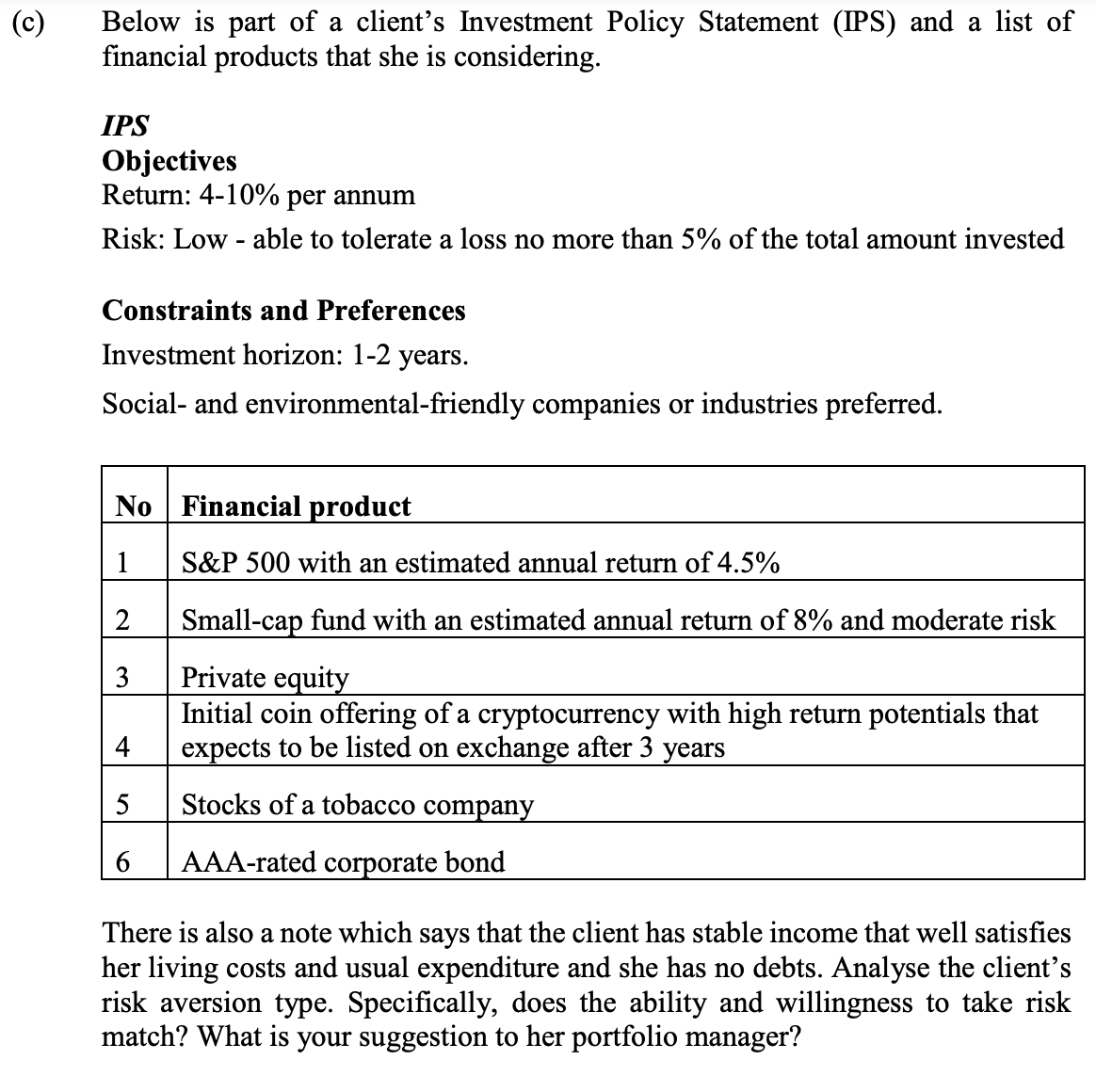

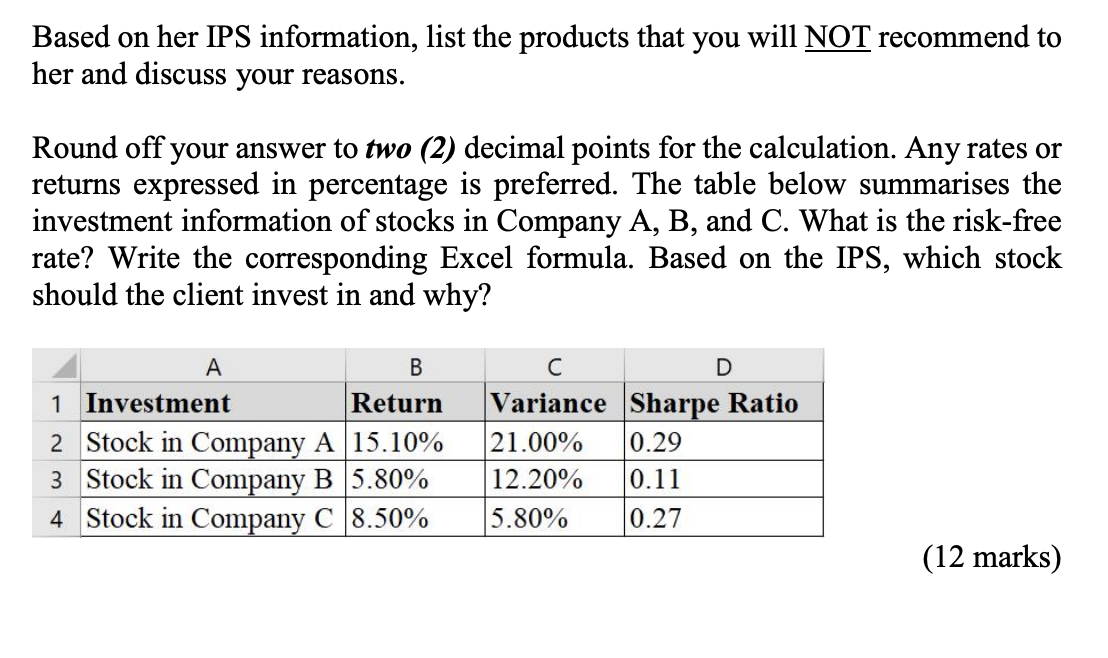

Question: Question 4 (a) Round off your answer to two (2) decimal points for the calculation. Any rates or returns expressed in percentage is preferred. An

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts